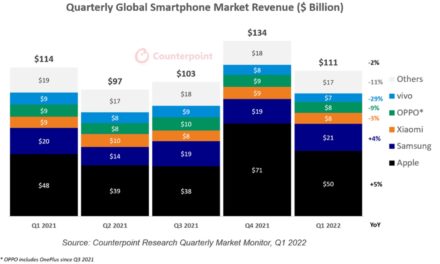

Apple’s high yield savings account brought in as much as US$990 million in deposits over its first four days, reports Forbes, quoting two unnamed “sources familiar with the matter.” On launch day alone, the savings account drew nearly $400 million deposits, the article adds.

By the end of launch week, roughly 240,000 accounts had been opened, one source told Forbes. When asked about the deposit and account figures, Apple and Goldman Sachs declined to comment.

“Banks have quickly responded to the Fed’s interest rate hikes with higher mortgage and car loan rates, but savers have seen little to no increase in traditional bank deposits or savings accounts,” Richard Crone, CEO and founder of payments firm Crone Consulting, said. “There’s an outflow to CDs, money market funds, and fintechs like Apple.”

Starting April 17, Apple announced that Apple Card users could choose to grow their Daily Cash rewards with a Savings account from Goldman Sachs, which offers a high-yield APY (annual percentage yield) of 4.15% — a rate that Apple says is more than 10 times the national average.

With no fees, no minimum deposits, and no minimum balance requirements, users can easily set up and manage their Savings account directly from Apple Card in Wallet, according to Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet.

Once a Savings account is set up, all future Daily Cash earned by the user will be automatically deposited into the account. The Daily Cash destination can also be changed at any time, and there’s no limit on how much Daily Cash users can earn. To build on their savings even further, users can deposit additional funds into their Savings account through a linked bank account, or from their Apple Cash balance.

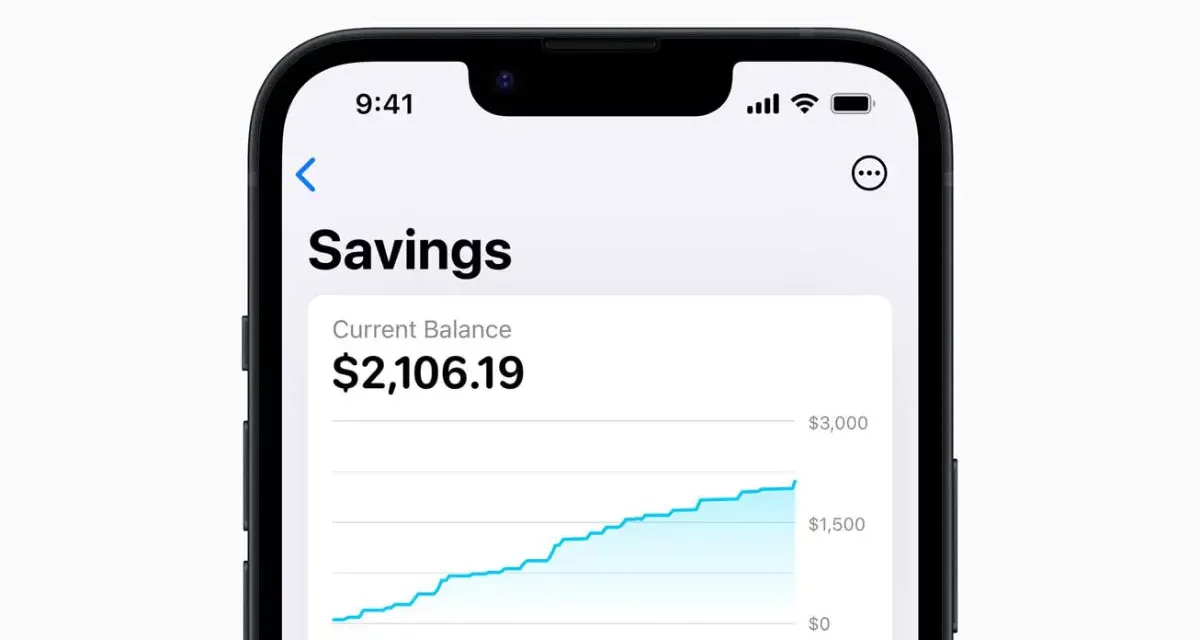

Users will also have access to a Savings dashboard in Wallet, where they can track their account balance and interest earned over time. Users can also withdraw funds at any time through the Savings dashboard by transferring them to a linked bank account or to their Apple Cash card, with no fees.

Article provided with permission from AppleWorld.Today