The Apple Card, created by Apple and issued by Goldman Sachs, is ranked highest among the Midsize Credit Card segment in the J.D. Power 2021 U.S. Credit Card Satisfaction Study. It also received a chart-topping score of 864.

The Apple Card and issuer Goldman Sachs also ranked highest in the Midsize Credit Card segment across all of the surveyed categories, including interaction, credit card terms, communication, benefits and services, rewards, and key moments.

“It is exciting to be recognized with this first J.D. Power win, just two years after introducing Apple Card in 2019 and the first time being included in this study,” said Jennifer Bailey, Apple’s vice president of Apple Pay. “We designed Apple Card to help our customers lead healthier financial lives, so it’s incredibly meaningful to see that our customers are valuing this. Being recognized as the leader in this category this year is an honor, and we look forward to continuing to deliver this product, service, and support with our award-winning issuer as Apple Card expands to more and more customers across the U.S.”

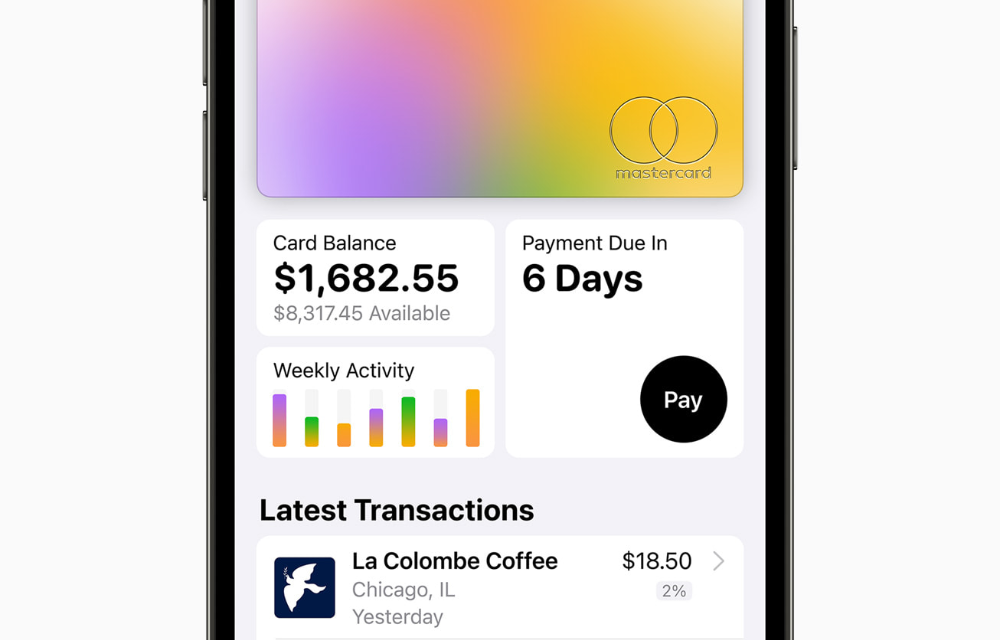

The Apple Card launched in 2019 as the first credit card designed for the iPhone. It’s a no-fee credit card that provides customers with a way to manage their finances right from Apple Wallet on the smartphone.

The Apple Card also offers Daily Cash rewards when customers spend online or in-store, including 3% Daily Cash back on purchases made directly with Apple and select merchants with Apple Pay, and 2% on purchases through Apple Pay.

Earlier this year, Apple introduced Apple Card Family, which allows Apple Card customers to share an Apple Card account with their Family Sharing group and build financial habits together. With Apple Card Family, two individuals 18 years or older can become co-owners of the same account, providing the opportunity for both to build credit history together, get the flexibility of a combined limit, provide transparency into each other’s spending, share the responsibility of making payments, and deliver the convenience of a single monthly bill to pay. Additionally, with Apple Card Family, customers can share their Apple Card account with up to five participants, including children 13 years or older, who can learn how to spend responsibly and earn their own Daily Cash on their own purchases, while giving co-owners transparency and control over their spending. Participants over the age of 18 can also opt in to credit reporting so they can begin to build credit history.

Apple works with Goldman Sachs Bank USA, Salt Lake City Branch as their bank issuing partner, and Mastercard as their network for the credit card. The Apple Card is available for qualifying applicants in the United States.

Article provided with permission from AppleWorld.Today