Apple says last year, users earned over US$1 billion in Daily Cash from spending on Apple Card and enjoyed many other benefits.

Five years after Apple Card was first introduced in 2019, 12 million Apple Card users are reaping the benefits of Apple Card’s award-winning experience, according to Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet. From easy-to-navigate spending tools, to Apple Card Family, and the recently added Savings account,1 Apple Card continues to reinvent the credit card experience and provide features designed to help users lead healthier financial lives, she says.

According to Apple, using Apple Card’s digital-first tools and benefits, users are:

- Saving for the future and growing their rewards with Savings:The Savings account quickly became a favorite feature among Apple Card users and reached over $10 billion in deposits in just a few short months. Today, the vast majority of users auto-deposit their Daily Cash into Savings, and nearly two-thirds of users have deposited additional funds from a linked bank account to further help them save for the future.2 Today, Savings offers a high-yield APY of 4.50 percent.3

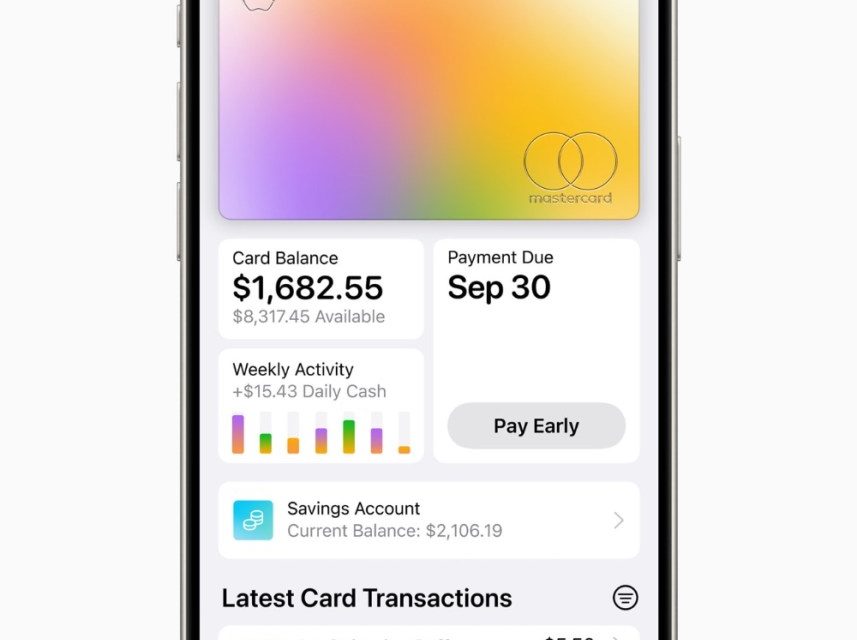

- Making healthy financial decisions with Apple Card’s payment tools: Nearly 30 percent of Apple Card customers make two or more payments per month. Apple Card makes it easier for users to understand and pay their bill, as payments are always due on the last day of the month, and with the help of the interest estimator tool, users can easily view the balance on their card and use the tool to estimate the potential interest in real time so they can make an informed decision before they make a payment.

- Using Apple Card Family to extend healthy finances to the Family Sharing Group:Since its introduction in 2021, more than 1 million Apple Card users share Apple Card with their Family Sharing Group through Apple Card Family, and nearly 600,000 users are building credit equally with their spouses, partners, or another trusted adult on Apple Card.4

- Utilizing Path to Apple Card to extend their access to credit:Since its introduction, over 200,000 users and counting have been approved for an Apple Card after enrolling in the Path to Apple Card program and successfully following the program’s personalized steps, which are designed to improve a user’s financial health.

- Enjoying the privacy and security of Apple Card:Built with the privacy and security of iPhone,and unique features such as Advanced Fraud Protection, Apple Card offers real-time fraud protection, and in 2024 was recognized as the Best Credit Card for Privacy by Bankrate.

Article provided with permission from AppleWorld.Today