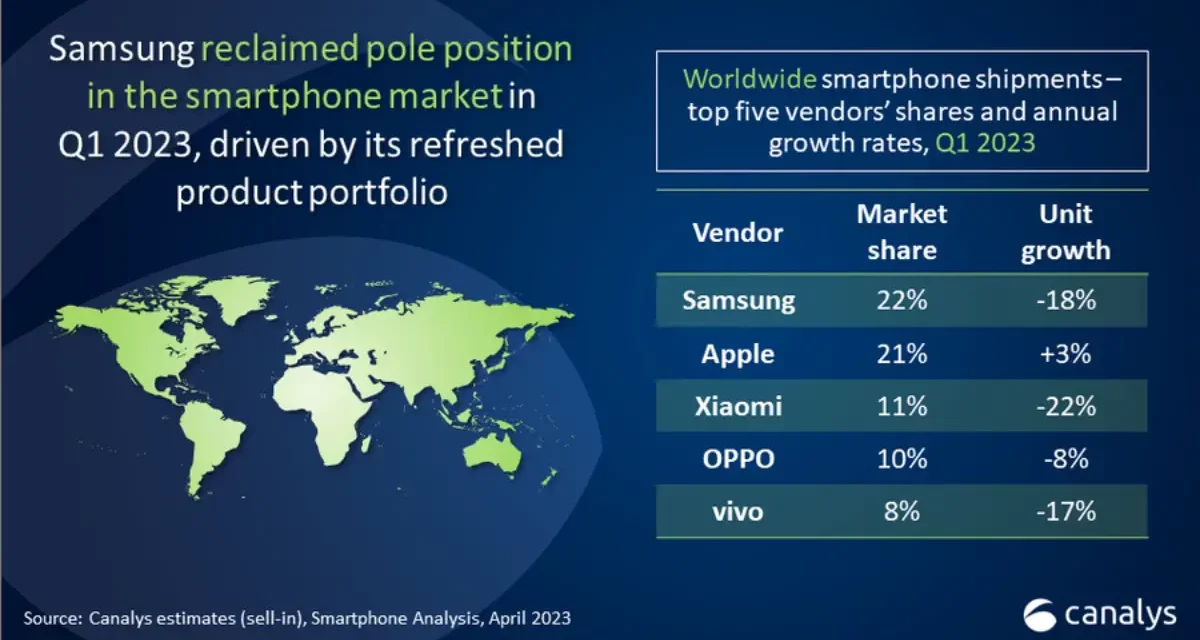

Canalys’ latest research shows that global smartphone shipments fell by 13% to 269.8 million units in quarter one (Q1) of 2023.

Samsung reclaimed its pole position and shipped 60.3 million units, driven by a refreshed product portfolio. Apple came in second with 58 million shipments. It was the only top five vendor to grow year-on-year, which gave it a strong 21% market share.

Samsung now has 22% of the global smartphone market, down 18% from Q1 of 2022. Apple now has 21% of the global smartphone market, up from 18% in Q2 of 2022.

Xiaomi defended its number three position with 30.5 million shipments while OPPO and vivo completed the top five, shipping 26.6 million and 20.9 million units, respectively, securing 10% and 8% market share.

“Samsung’s performance shows early signs of recovery after a tough end to 2022,” says Runar Bjørhovde, Canalys analyst. “The rebound is particularly connected to product launches, which drove an increase in sell-in volume. Still, Samsung will have to navigate through a difficult landscape going forward, particularly as entry-level device inventory remains high. Declining profits from its semiconductor memory business will also trigger a more conservative marketing spend overall.”Meanwhile, Apple had robust performance in Q1, particularly in the Asia Pacific region, he adds. Here, Apple’s sustained investments into offline channels enabled it to attract a burgeoning middle-class, which places high value on the in-store purchasing experience, according to Bjørhovde.

Canalys says the demand decline for smartphones has started to flatten, although the contrast between Q1 2022 and Q1 2023 is still stark.

Article provided with permission from AppleWorld.Today