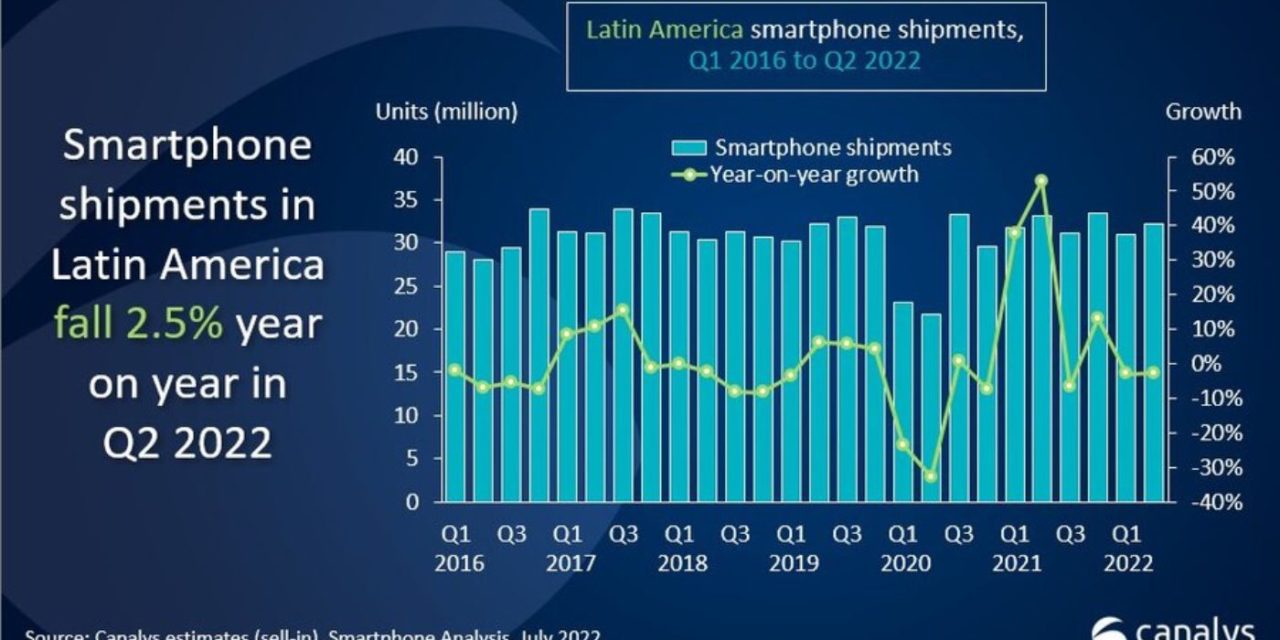

Latin American smartphone shipments fell 2.5% year on year in quarter two (Q2) 2022, coming in at 32.2 million units, according to Canalys. However, Apple’s iPhone beat the trend.

The research group says Q2’s smartphone sales dip follows a 2.5% drop in the last quarter, making the first two consecutive declines in the Latin American region since the beginning of the pandemic in Q1 and Q2 2020.

Apple sold 1.5 million iPhones in Q2 of 2022, giving it 5% of the Latin American smartphone market. That compares to sales of 1.3 million and 4% market share in Q2 of 2021 — and annual growth of 16%.

Ahead of Apple in the Latin American market as of Q2 2022 are: Samsung (11.6 million sales, 36% market share); Lenovo (6.9 million sales; 22% market share), and Xiaomi (5.3 million sales; 17% market share).

“The second quarter deepened the trend of polarization, with both the sub-US$100 and US$500-plus price bands strengthening,” says Canalys Senior Analyst Damian Leyva-Cortes. “This trend is mainly benefiting Apple, as its entire portfolio is priced over US$500. Apple coupled the successful launch of the iPhone 13 series with a conservative pricing approach, which, in a hyperinflationary environment, brought good results in the form of double-digit year-on-year shipment growth of 16%. Lenovo and Samsung also benefited from this trend to elevate the value of their shipments, though shipment numbers were hurt by exposure to other price bands, with both companies seeing falls below the overall market decline.”

Despite the decline, Latin America’s Q2 figure beats the overall global year-on-year decline (-9%), though there are growing concerns about specific markets, such as the Peru and Chile, which suffered double-digit falls during the quarter, according to Canalys.

Article provided with permission from AppleWorld.Today