As September 2021 approaches, iPhone users are anticipating the launch of the next model in Apple’s line of flagship smartphones. Industry experts expect the iPhone 13 to debut around September 13 or 14, with preorders on the 17.

Is the iPhone 13 likely to be a sensible financial choice (vs other smartphones) as the iPhone 12 has proven itself to be? A study by SellCell says this should be the case.

The site for selling phones online has taken the iPhone 11 and 12 depreciation data, comparing the two to better understand whether the iPhone 13 is likely to retain its value and prove to be a strong asset for consumers. Key findings include:

- Both the iPhone 11 and iPhone 12 ranges lose on—average—40 %– 50% of their value within the first four weeks of launch.

- Post iPhone 12 launch, the iPhone 11 range lost a further 8% of its value within three months and 10% of its value within nine months.

- Despite an initial steep reduction in value, the iPhone 11 range exhibits a steadying in its depreciation, retaining value well.

- The iPhone 12 range improves on the performance of its predecessor. Six months following launch sees the iPhone 12 range losing 34.5% of its value, while the iPhone 11 range lost 43.8% over the same time period. The iPhone 12 range is currently holding 9.3% more value than the iPhone 11 range did six months post-launch.

- The iPhone 12 Mini has depreciated the most from the iPhone 12 range of handsets, losing 41.0% after six months. This is almost 9% more on average than the other devices evaluated.

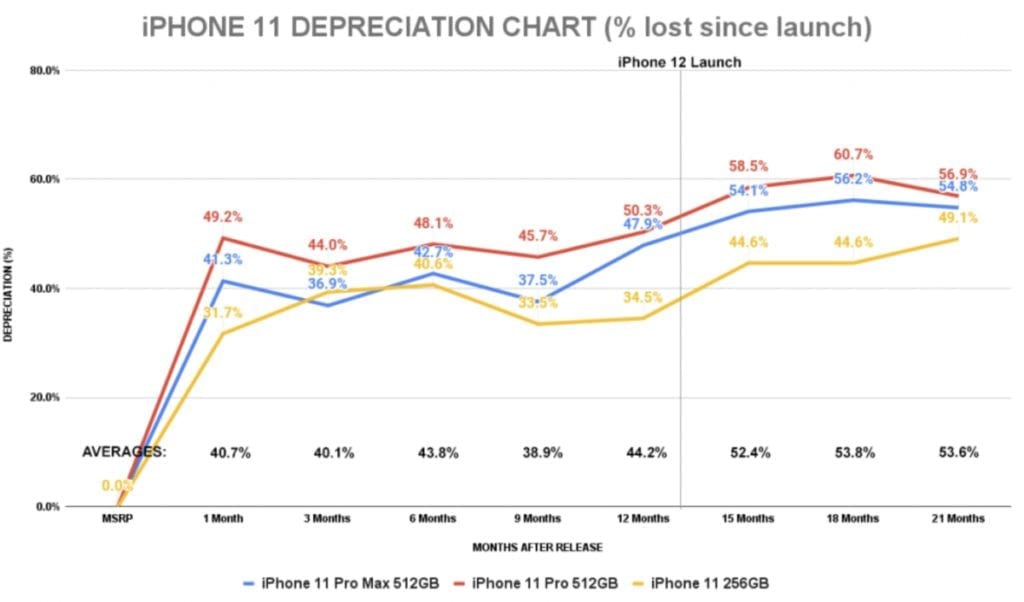

iPhone 11 depreciation

The iPhone 11 saw a sharp increase in value lost since launch within one month of release. In fact, this is where we see the most dramatic percentage loss throughout the range’s life-cycle.

The iPhone 11 (256 GB model)—despite being the least expensive in this line of Apple smartphones—held its value best during this period, yielding a loss in value of only 31.7%.

This is 17.5% less depreciation than the iPhone 11 Pro (512 GB model) and 9% less depreciation than the average across all three handsets. The iPhone 11 continues this trend throughout its 21 months since launch, having lost 49.1% of its value.

Comparatively, the iPhone 11 Pro Max sees a depreciation 5.7% higher than the standard iPhone 11, over the same 21-month period. The iPhone 11 Pro is the worst performer, losing 56.9% of its value in the 21 months since launch.

So what do these figures look like it monetary terms? According to SellCell, the standard iPhone 11 dropped from its manufacturer’s suggested retail price (MSRP) of US$849, down to a value of $432. While this is the lowest value after 24 months, it is also the lowest MSRP, meaning the handset held its value better than the other two iPhone 11 devices.

By October 1st, 2009— one month post-launch—the iPhone 11 Pro had lost a $664 of its $1,349 MSRP, while the iPhone 11 Pro Max fared little better, dropping by $599. However, SellCell says we see both the iPhone 11 Pro Max and iPhone 11 Pro increasing in value.

The standard iPhone 11 has dropped in value between 18-21 months, losing $38. SellCell says this trend may continue as we reach the end of month 24, which should also mark the release of the iPhone 13.

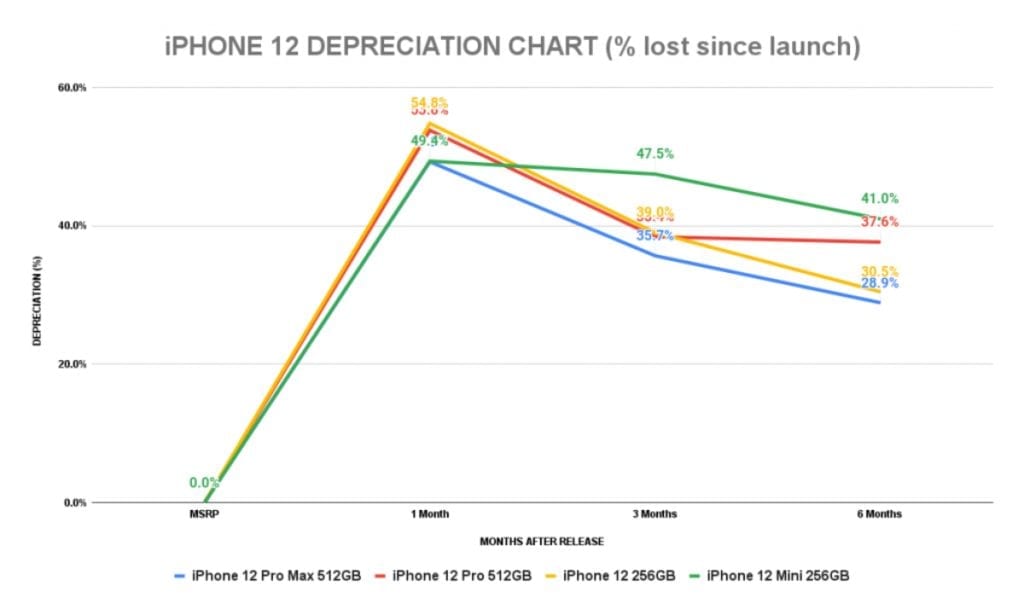

iPhone 12 depreciation

The iPhone 12 range paints a similar picture to that of the iPhone 11. Apple released the iPhone 12 Pro Max, 12 Pro and 12 in October 2020 and then the iPhone 12 Mini followed shortly afterwards in November 2020. This marked a delay to the 12 month timeframe we would normally attribute to Apple’s iPhone release roster.

However, a global electronic component shortage and logistics issues haunted the entire tech industry during the 2020 COVID crisis. As a result, Apple delayed the release of its 12-series handsets.

Even so, the iPhone 12 handsets have retained their value very well during their six-month life-cycle, according to SellCell. Each handset has performed better than its iPhone 11 equivalent.

Over the six months since release, each handset recovered value. The iPhone 12 Pro Max went from losing 49.2% in month one, to a reduction in loss amounting to 28.9%. This is a recovery of 20.3% of the handset’s initial MSRP.

Again, in monetary terms the iPhone 12 series of smartphones is performing well, generally. The iPhone 12 Pro Max had lost $689 of its MSRP within a month of sale, valued at only $710.00. However, the same handset is now worth $995.00, meaning that it has recuperated $285.00 of its initial MSRP at launch.

SellCell says that this could be because, as we approach the release of the iPhone 13, we see increased demand for the iPhone 12 Pro Max, given that it is the highest spec phone in the 12 series.

This leads consumers (who are buying refurbished handsets) to take advantage of a good deal on a handset with the 12 Pro Max’s credentials; particularly as it is still retailing for $1,399.00 with Apple. Thus, as demand increases, so does the monetary value of the iPhone 12 Pro Max, according to SellCell.

In fact, all of the iPhone 12 series has recouped its value across all four handsets between months one and six, with varying degrees of success. The 12 has seen a recovery of $231 in this time period, the 12 Pro a recovery of $210 and the 12 Mini a recovery of $71. The iPhone 12 Pro Max regained $285.

iPhone vs Other Smartphones

It isn’t just when facing its Apple predecessors that the iPhone 12 performs well. SellCell says adversaries have also lost out to the iPhone 12. The Samsung Galaxy S21 range has fared nowhere near as well as the iPhone 12 in terms of value retention.

The iPhone 12-series handsets hold significantly more value than the Galaxy S21 range, despite Samsung releasing its flagship phone series after Apple released the iPhone 12 models. Previous studies show that an iPhone 12 is holding its value by 20% more than the newly released S21.

The figures are equally grim for other brands, not just Apple’s chief rival Samsung. Android brand loyalty is falling, with many Android users across Google, Motorola, and (now defunct in the smartphone marketplace) LG consumers all look to switch to the Apple ecosystem.

Samsung still comes out of this smartphone war the most serious casualty, though, with 26% of its consumer base seeking to switch brand when they are due to upgrade. If this is around the time of the iPhone 13 release, it could see many of them jumping ship for Apple’s high-end devices.

Will the iPhone 13 Be a Smart Purchase Decision?

SellCell says that, really, all phones are a poor investment as they depreciate and lose money. In terms of retaining value the iPhone 12 is a good purchase decision, even more so than the iPhone 11. The iPhone 13 should therefore also be a sound choice. However, we can explain this further.

Given that iPhones across the 11 and 12 series have retained more value than any other smartphone brand, it should be clear that the next iPhone in the series, the iPhone 13, will follow suit and also reserve value well.

Not only that, but the 12 series has seen better value retention than the previous iPhone 11 series over the same six-month period. If the 13 follows suit, then the 2021 Apple handset line may continue the trend started by the 2020 range of iPhones, showing greater value retention.

SellCell says that Apple devices in general hold their value incredibly well, so any iPhone model is going to be an excellent investment. They show the least depreciation across the entire smartphone market.

However, SellCell says Apple’s handsets experience a drop in value when a new model launches. With this in mind, consumers looking to sell an iPhone would be wise to do so prior to the release of the iPhone 13. Comparison websites such as SellCell can help in this instance.

Methodology

SellCell gathered data relating to the value of the iPhone 11 and iPhone 12 smartphones. This data showed the value of each respective handset at launch and throughout its life-cycle. SellCell compared and contrasted this data in order to see depreciation trends across the 11 and 12-series devices, and ascertain whether the forthcoming iPhone 13 would prove to be a good investment for consumers based on these trends.

Article provided with permission from AppleWorld.Today