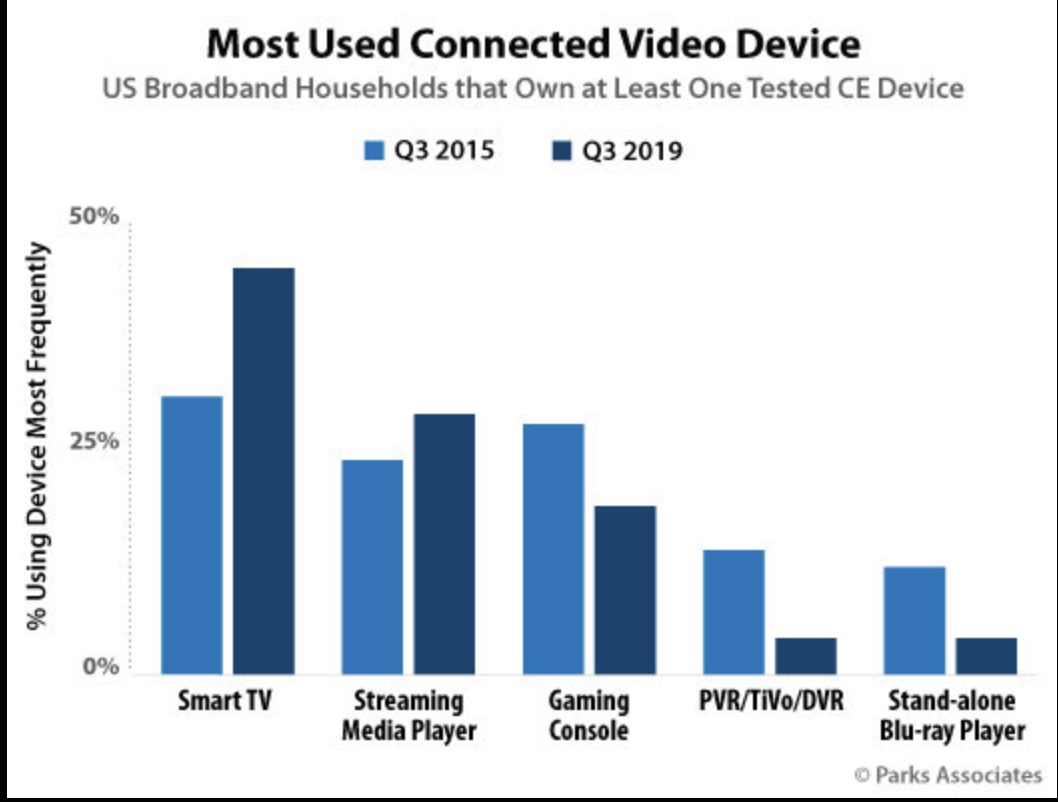

Research from Parks Associates finds 67% of US broadband households own and use at least one internet-connected video device, either a smart TV, streaming media player, internet-connected gaming console, or connected PVR/DVR.

The firm’s Connected Entertainment Ecosystems: Competition & Cooperation notes that these devices get plenty of use but also have lengthening replacement cycles, which is driving manufacturers to explore new strategies, including software and service offerings, exclusive hardware-content bundles, and open ecosystems. The challenges and thin margins in the CE are also narrowing the field of competitors.

“The connected entertainment space is moving towards a smartphone model, in which a handful of platform players control the operating system, UX, and consumer access to services and features,” said Kristen Hanich, senior analyst, Parks Associates. “These platform players stand to win big as consumers increasingly choose to sign up for their OTT service subscriptions through storefronts like Amazon Prime Video Channels, Apple TV Channels, or Roku Channel Premium Subscriptions.”

Connected Entertainment Ecosystems: Competition & Cooperation profiles the product ecosystems and market strategies for Apple, Amazon, Comcast, Google, Roku, Samsung, and Sony. It analyzes benefits and drawbacks of closed versus open device and app ecosystems and offers insights on consumer expectations for their devices as content consumption shifts toward streaming service options.

“Major changes in content distribution and consumption are affecting the CE market, notably the rise of OTT services and decline in pay-TV subscriptions,” Hanich said. “The increasing fragmentation in the content services market means there’s no single path to reach consumers. These factors, along with the consumer demand to access their content when and where they are, are pushing the connected entertainment market slowly but steadily in favor of open ecosystems where consumers can access most, if not all, of the services they want on the device they want regardless of which platform they decide to use.”

The report notes that in 2019 alone, 6.4 million U.S. consumers cut the cord on their traditional pay-TV service, transitioning to OTT streaming and/or broadcast television, both of which continue to rise in adoption and usage.