According to the International Data Corporation (IDC) Worldwide Quarterly Server Tracker, vendor revenue in the worldwide server market increased 4.4% year over year to $19.8 billion during the first quarter of 2019 (1Q19). Worldwide server shipments declined 5.1% year over year to just under 2.6 million units in 1Q19.

The overall server market slowed in 1Q19 after experiencing six consecutive quarters of double-digit revenue growth although pockets of robust growth remain. Volume server revenue increased by 4.2% to $16.7 billion, while midrange server revenue grew 30.2% to $2.1 billion. High-end systems contracted steeply for a second consecutive quarter, declining 24.7% year over year to $976 million.

“Demand from both enterprise buyers and hyperscale companies purchasing through ODMs was less voracious than in previous quarters; coupled with a difficult compare period from a year ago, this impacted the pace of market growth during the first quarter,” said Sebastian Lagana, research manager, Infrastructure Platforms and Technologies at IDC. “This was most evident in declining unit shipments during the quarter, although year-to-year average selling price (ASP) increases supported revenue growth for many vendors. As long as demand for richly configured servers supports further ASP growth, the market will offset slight declines in unit volume.”

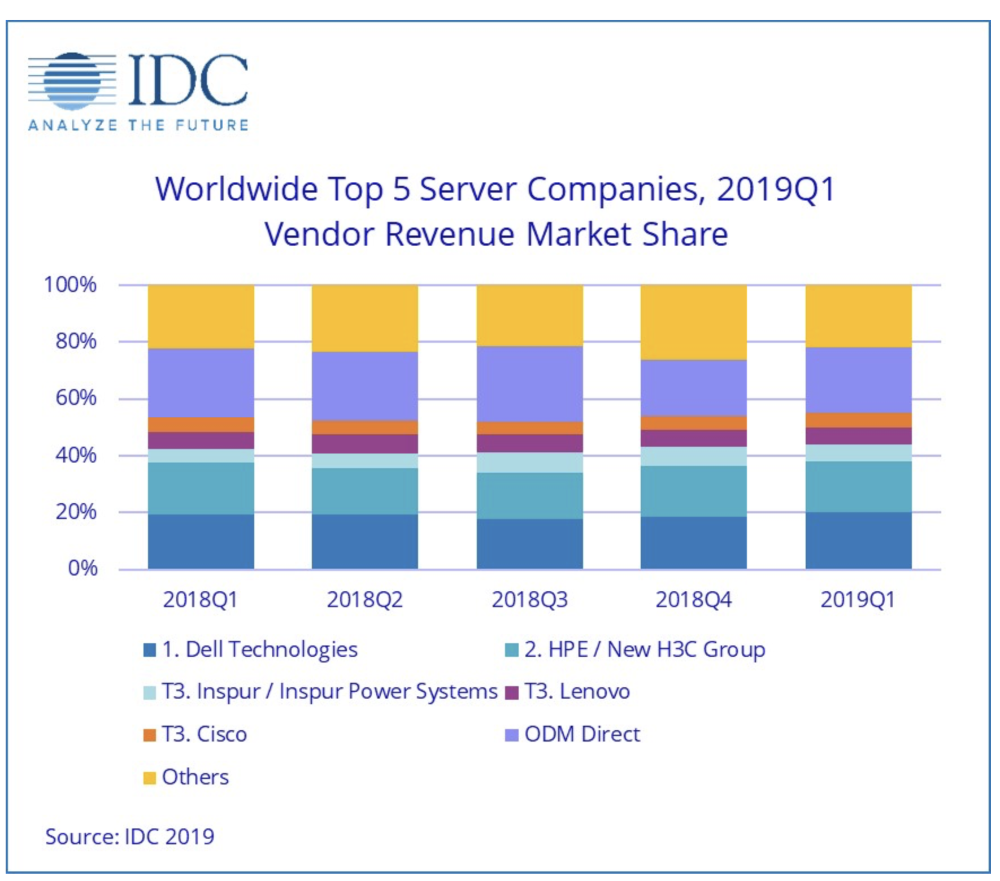

The number 1 position in the worldwide server market during 1Q19 was Dell Technologies with 20.2% revenue share, followed by HPE/New H3C Group, with 17.8% revenue share. Dell Technologies grew revenues 8.9% year over year while HPE/New H3C Group increased revenues 0.2%. Tied for the number 3 position during the quarter were Inspur/Inspur Power Systems, Lenovo, and Cisco, generating 6.2%, 5.7%, and 5.3% share total server revenues, respectively.

Inspur/Inspur Power Systems increased its revenue 36.4% year over year; Lenovo grew its revenue 3.9% year over year; and Cisco increased its revenue 6.9% year over year. The ODM Direct group of vendors accounted for 23.0% of total market revenue and declined -1.0% year over year to $4.55 billion.