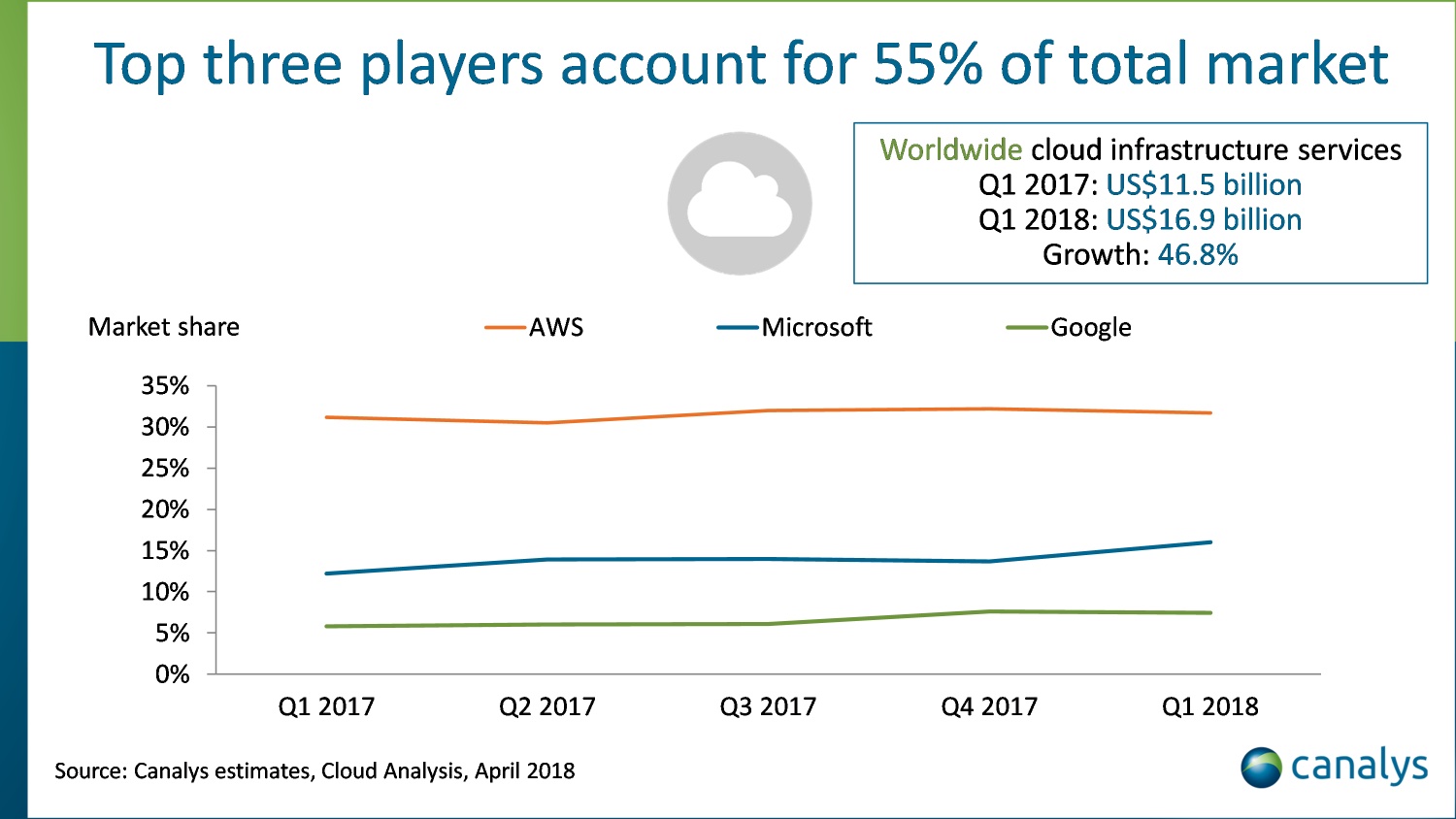

Worldwide spending on cloud infrastructure services continues to grow, reaching $17 billion in the first quarter of 2018, according to Canalys (www.canalys.com). This represents a 47% increase on the same period last year, adds the research group.

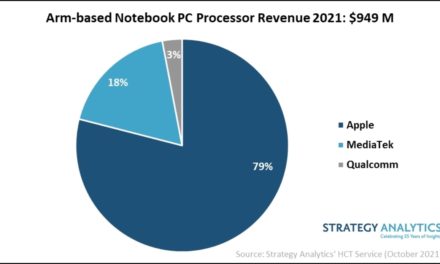

Amazon Web Services (AWS) stayed ahead of the competition, up 49% this quarter. The market leader’s revenue is nearly double that of its nearest competitor, Microsoft (up 93%), which continued to grow faster than AWS. Google was ranked third, up 89% to $1.2 billion.

Cloud adoption has been a key part of businesses’ digital transformation strategies due to its multiple benefits, including elasticity, scalability, on-demand provision of virtualized and container resources, and low upfront costs. However, complexity and uncontrolled user access to cloud technologies has led to customers underusing paid-for services and not fully realizing the return on investment.

“According to a Canalys survey of 146 channel partners around the world, over 80% of respondents believe their customers’ cloud expenditure is not fully used,” says Daniel Liu, research analyst at Canalys. “58% of partners believe up to 20% of their customers’ cloud investment is wasted, while 26% think the wastage is more than 20%.”

This is creating opportunities for channel partners, as more organizations are migrating to public cloud services and opting for multiple providers while integrating them with their existing IT infrastructure.

“The main role for channel partners after migrating and integrating customer workloads to a hybrid environment will be giving them greater visibility into available cloud resources to optimize use,” Liu says. “This will be driven by analytics and, in future, machine learning to identify the optimal cloud package or subscription. But the skills needed for workload cloud migration, consumption monitoring, billing analytics, cloud consultation and integration services are in short supply.”