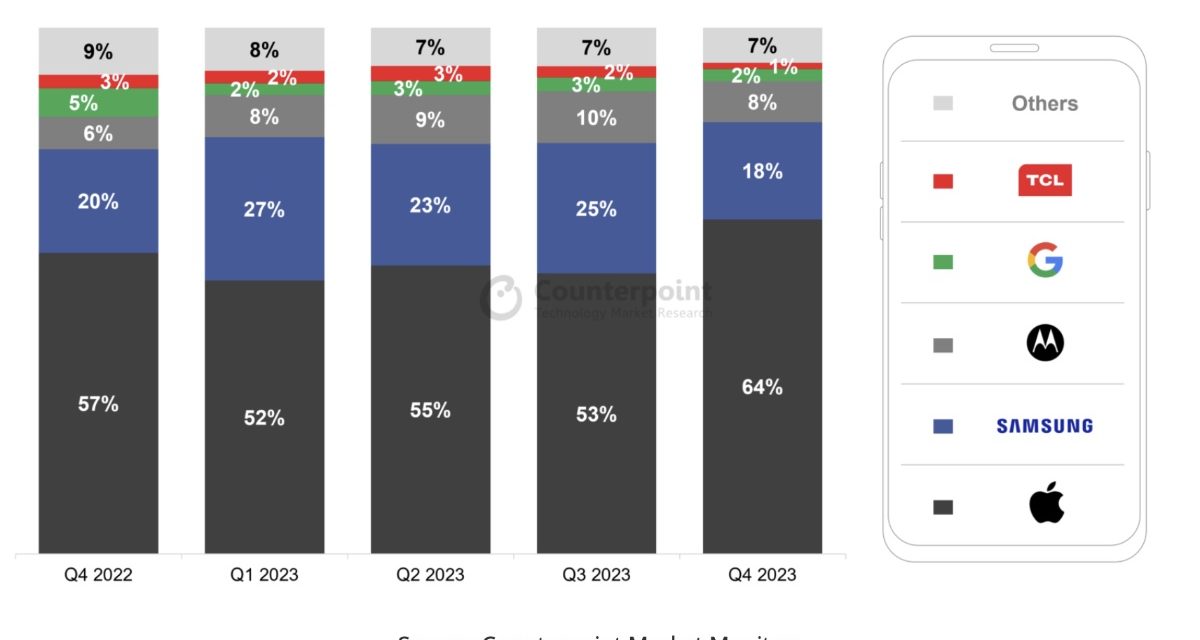

US smartphone shipments grew 8% year-over-year (YoY) in quarter four (Q4) of 2023, according to Counterpoint Research’s Market Monitor data.

The research group says that this was primarily due to Apple’s sell-in rebounding strongly from the previous year’s COVID-19-induced factory shutdowns that caused production disruptions. Android sell-in declined over the same period, as the sub-$300 segment saw declining demand.

“Q4 is usually very robust for Apple given the strong demand for iPhones during the holiday sales,” says Jeff Fieldhack, Counterpoint’s research director for North America. “Throughout 2023, Apple made inroads in prepaid with its N-2 or N-3 devices, selling the iPhone 12 or iPhone 11 at very reduced prices, which also helped it grow its market share in this segment.”

Regarding Android shipments, Senior Analyst Maurice Klaehne says, “While Q4 saw a slowdown in premium sales, it was the sub-$300 segment that saw the largest declines. Prepaid-to-postpaid migration continues to be robust and cable players like Comcast’s Xfinity Mobile and Charter Communications’ Spectrum Mobile are getting strong net-adds. Prepaid upgrade eligibilities have gone from 90 days to as high as 365 days. All these factors contribute to lower demand for prepaid smartphones.”

Article provided with permission from AppleWorld.Today