According to the International Data Corporation ’s (IDC) Worldwide Quarterly Mobile Phone Tracker, Thailand’s smartphone market saw initial signs of a recovery in 3Q23 after six consecutive quarters of annual decline as the market grew 1.6% year-over-year (YoY) and 8.3% quarter-over-quarter (QoQ).

Growth was particularly strong in the premium segment (US$1,000+) which grew 25.9% YoY driven by new model launches such as Apple’s iPhone 15 series and Samsung’s Galaxy Z Flip5 and Galaxy Z Fold5.

The mid-range (US$200<US$400) also grew significantly in both value and volume, particularly driven by OPPO, Samsung and Xiaomi with the segment growing 61.8% YoY. The Average Selling Price (ASP) for the entire market was US$360, rising 7.8% YoY.

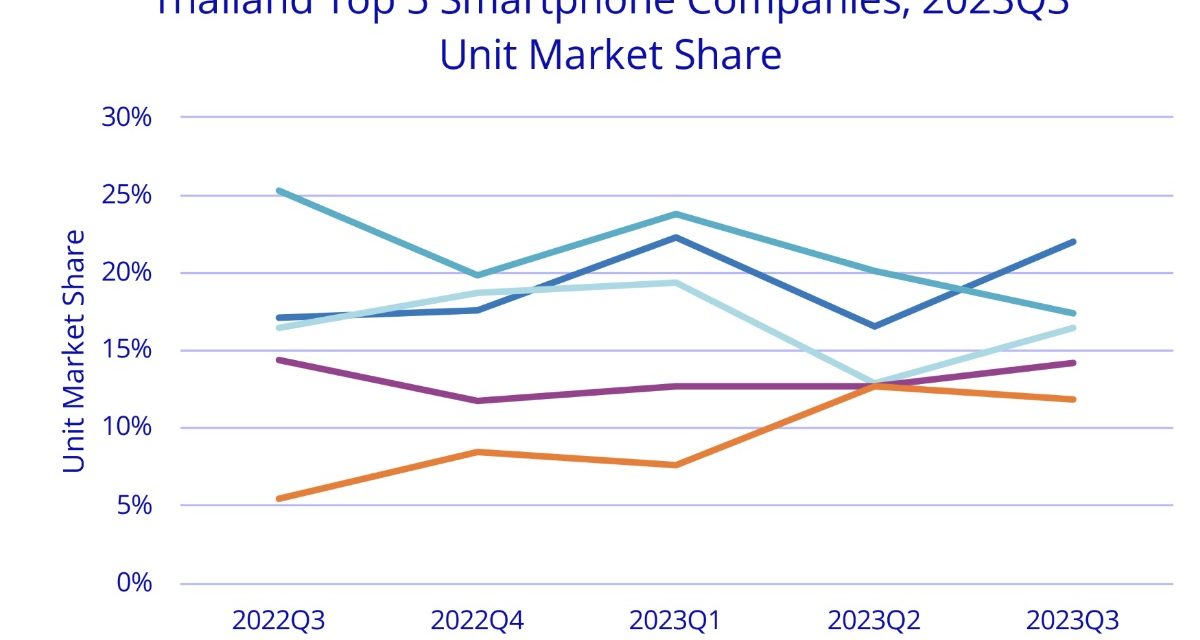

OPPO rose to first place due to its mid-to high-end Reno 10 Series, various new low-end model launches, and partnerships with telcos. Samsung, in second place, focused on the premium segment with its new foldable range as well as the mid-range segment with the Galaxy A series. Apple remained firmly in third with an increase in total shipments from both new models and previous generation models.

Apple now has 16.5% of the Thailand smartphone market based on sales of 623,000 units in the third quarter. That compares to sales of 612,000 iPhones and 16.5% in market share in the third quarter of 2022. iPhone sales grew 1.8% annually.

Article provided with permission from AppleWorld.Today