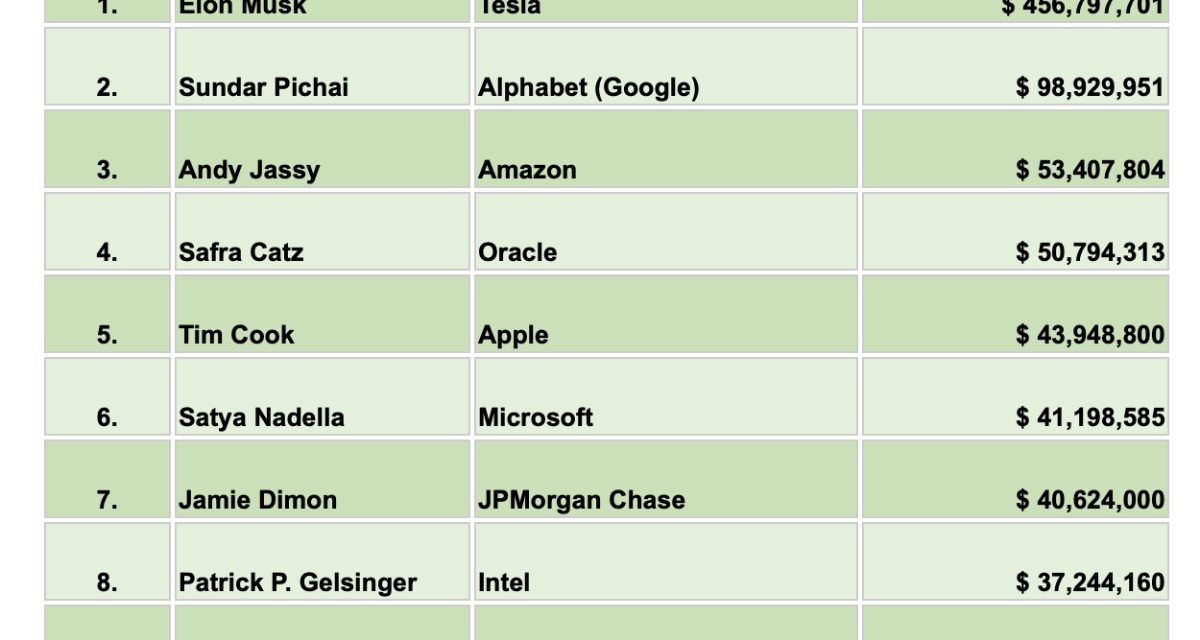

A new study has named Elon Musk as the CEO who received the most bonus payment in recent years. Apple CEO Tim Cook came in fifth.

The analysis undertaken by The Stock Dork examined bonus payments of CEOs from the top 50 market cap companies over the last five years to determine those with the highest compensation payments and average compensation over the period.

The CEO with the most impressive average yearly bonus is Musk of Tesla. Musk’s average yearly bonus stands at at US$456.7 million. A significant chunk of this average was influenced by a massive one-time stock option bonus of $2.23 billion in 2018, the largest ever given to a CEO.

In second place is Sundar Pichai of Alphabet. His average yearly bonus is a whopping $98.9 million. In 2022 he received $10 million as a cash bonus and $42.2 million as stocks, which means that for every dollar the median Google employee earned, Pichai took home $275 in bonus payments.

Securing third place is Andy Jassy of Amazon. His yearly bonus average lands at $53.4 million. The Amazon CEO’s highest recent bonus was in 2021, when he received a $211 million equity bonus. Andy Jassy collected $6,198 as bonus payments for every dollar the typical Amazon worker made.

Safra Catz of Oracle takes the fourth spot with an average bonus of $50.8 million a year. In 2022, Catz was awarded $129 million in stock options, which, when broken down, reveals that for every dollar earned by the average Oracle employee, Catz took home $1,723 in bonuses. Stock awards comprise a considerable portion of her compensation, reflecting Oracle’s long-term growth strategy.

In fifth place, we find Cook, whose yearly bonus averages $43.9 million. In 2022, Tim was awarded $82 million in stocks, which means that for every dollar the average Apple employee earned that year, their CEO took home $982 in stock bonuses.

Though Cook was also awarded a $12 million cash bonus, Apple heavily leans on stock awards for executive bonuses, ensuring that CEO interests align with those of the shareholders.

For this analysis, The Stock Dork used data from the companies’ most recent financial statements, SEC filings, and public annual reports.

Article provided with permission from AppleWorld.Today