Apple’s upcoming Apple Pay Later service will only allow people to borrow a maximum of $1,000 based on their credit rating and other factors, including their Apple ID, reports iMore.

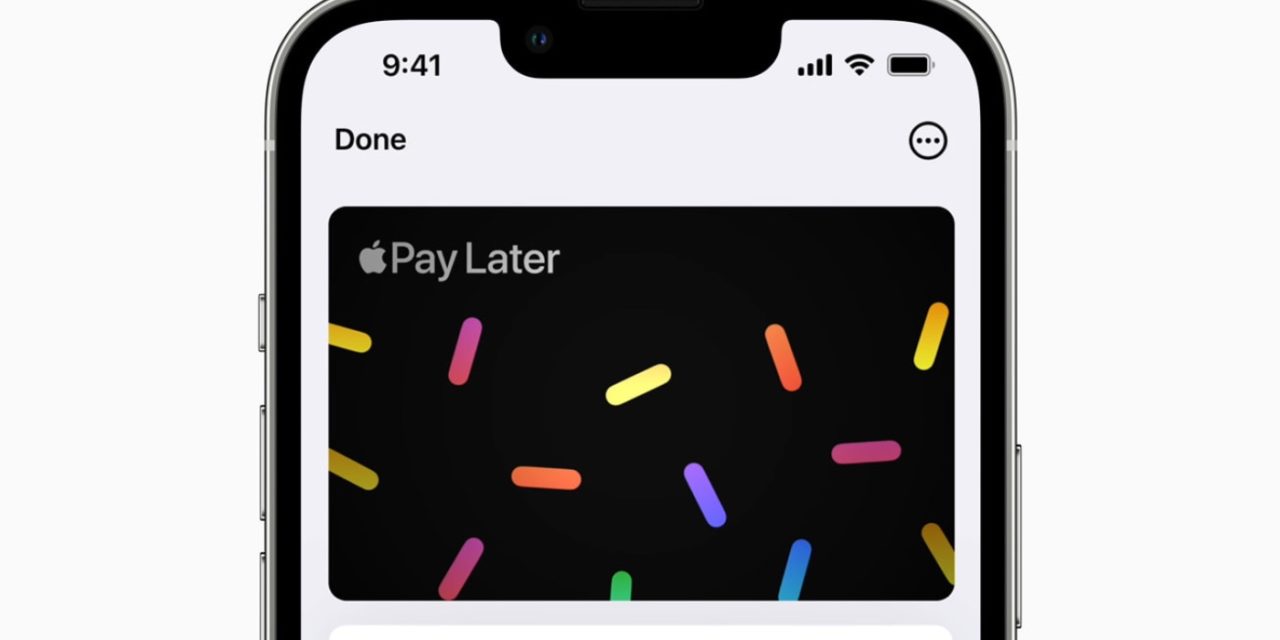

Apple Pay Later was announced at the 2022 Worldwide Developer Conference and provides users in the US with a way to split the cost of an Apple Pay purchase into four equal payments spread over six weeks, with zero interest and no fees. Users can track, and repay Apple Pay Later payments within Wallet.

Users can apply for Apple Pay Later when they’re checking out with Apple Pay, or in Wallet. Additionally, with Apple Pay Order Tracking, users can receive detailed receipts and order tracking information in Wallet for Apple Pay purchases with participating merchants.

From iMore’s report: Payment plans per transaction will max out at $1,000, and the amount for which consumers are approved will depend on their credit reports and scores.

Apple also will factor in its own information on millions of customers for identity verification and fraud prevention, the people said. Applicants whose Apple IDs have been in good standing for a long period and who have no indication of fraud are more likely to get approved.

Article provided with permission from AppleWorld.Today