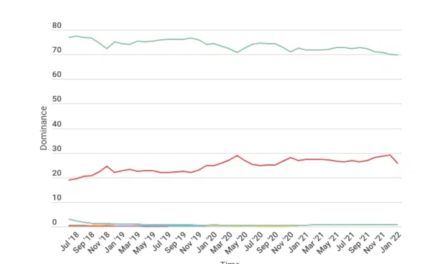

COVID-19 has created consumer interest and use of contact-free payment experiences as fear of infection from surfaces, including a point-of-sale (POS) device and drives new behaviors, according to Research and Markets.

While reports and surveys proclaim cardholders’ interest in contactless technology, the actual number of contactless debit transactions authorized on a contactless card or mobile app remains elusive, adds the research group.

The onset of the coronavirus created the perfect storm of events that is driving awareness more quickly than all the promotional activities have to date. Research and Markets says cardholders’ wellbeing is the incentive to adopt a new payment method. More consumers are now aware of the contactless capabilities they have on their debit card, which is driving new users in addition to increased use by current users.

Highlights of the Research and Markets report include:

- Prior to the onset of the coronavirus, debit card issuers had been actively issuing contactless debit cards for the improved user experience, and hoping to convert cash transactions to interchange earning payments as experienced in similar economies like Australia, Canada and the United Kingdom.

- While adoption of contactless by merchants has also been growing, it will likely create higher card processing fees. Contactless transactions are often routed through the global networks, which may be more expensive than an EFT debit network transaction. Also, if the experience of other countries is repeated in the U.S, cash purchases will now incur more visible interchange expense and processing costs.

- Cardholder interest in contact-free transactions, including recent survey data collected in June 2020, measures the increased use of contactless by current users and new users.