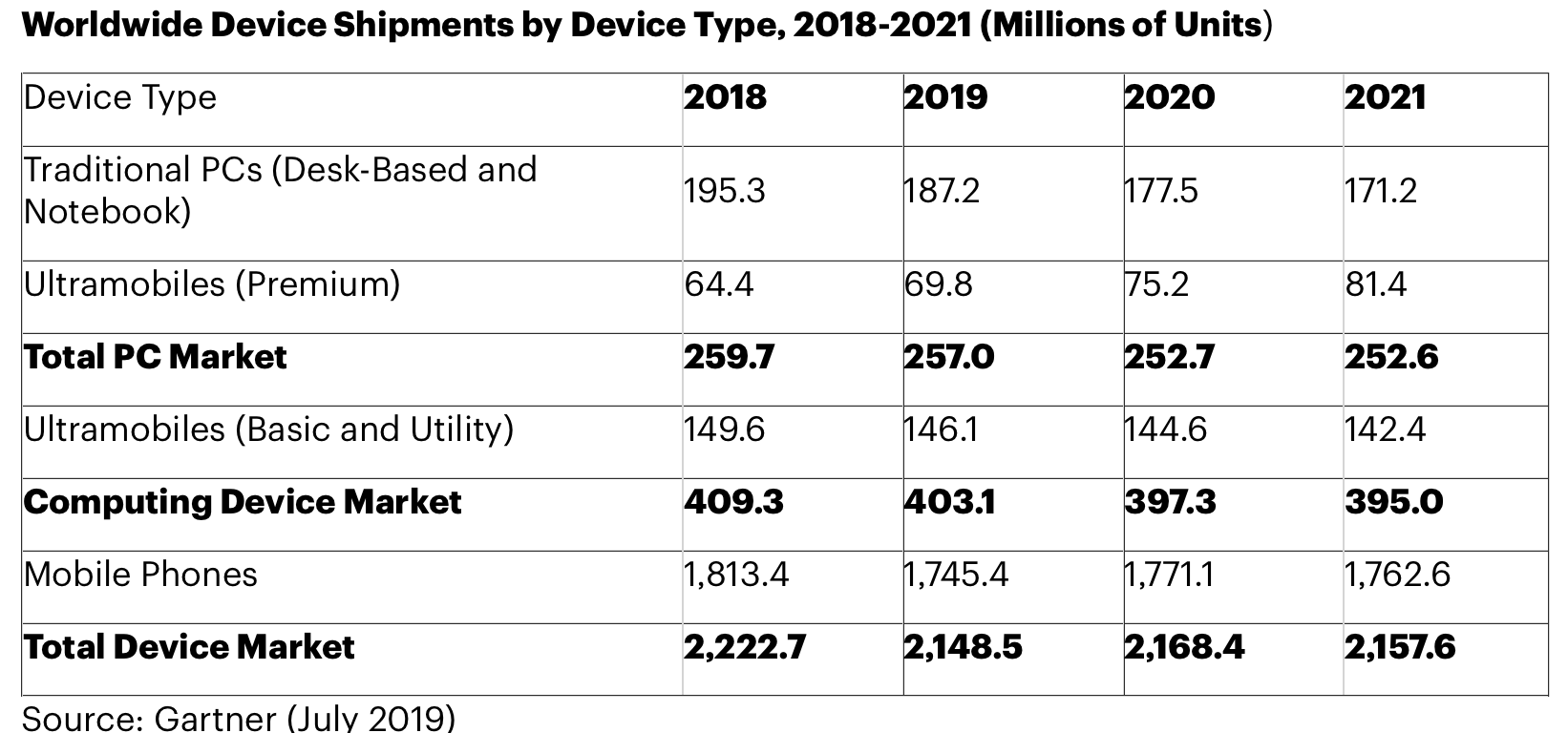

Worldwide shipments of devices — PCs, tablets and mobile phones — will total 2.2 billion units in 2019, a decline of 3.3% year over year, according to Gartner, Inc. (www.gartner.com). The mobile phone market is set to record the worst performance of these device types, declining by 3.8%, adds the research group.

“The current mobile phone market of 1.7 billion shipments is around 10% below the 1.9 billion shipments reached in 2015,” said Ranjit Atwal, research director at Gartner. “If mobile phones don’t provide significant new utility, efficiency or experiences, users won’t upgrade them, and will consequently increase these devices’ life spans.”

The trend for lengthening mobile phone life span began in 2018 and will continue through 2019. Gartner predicts that high-end phone life span will increase from 2.6 years to nearly 2.9 years through 2023. Gartner estimates that sales of smartphones will decline by 2.5% in 2019, which would be the worst decline ever.

Earlier this year, mobile operators launched 5G services in parts of the U.S., South Korea, Switzerland, Finland and the U.K., but it will take time for carriers to expand 5G coverage beyond major cities.

By 2020, Gartner estimates that 7% of global communications service providers will have a commercially viable wireless 5G service. This will mark significant progress from 5G proofs of concept and commercial network construction work in 2018.

In the first half of 2019, several phone manufacturers released 5G-enabled smartphones. To improve slowing smartphone sales, mobile manufacturers are looking to introduce more affordable 5G-enabled phones in 2020.

“In 2020, 5G-capable phones will represent 6% of total sales of phones. As 5G service coverage increases, user experience will improve and prices will decrease. The leap will occur in 2023 when we expect 5G phones to account for 51% of phone sales,” said Atwal. “Product managers should ensure high-end phones are differentiated by application integration with other devices, rather than relying just on 5G hardware evolution.”

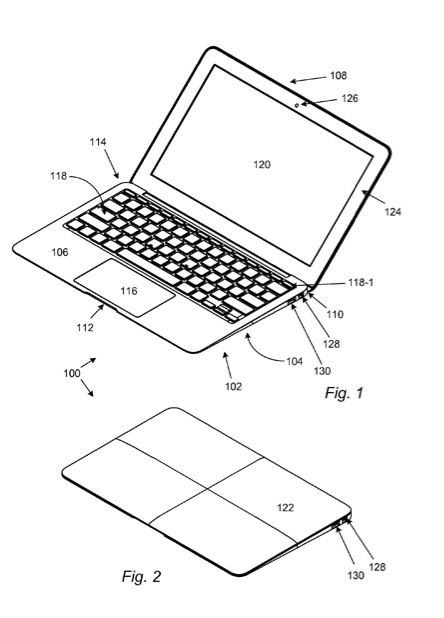

While worldwide PC shipments totaled 63 million units and grew 1.5% in the second quarter of 2019, there is still uncertainty for PC demand in 2019. PC shipments are estimated to total 257 million units in 2019, a 1% decline from 2018.

“The ongoing trade dispute between the U.S. and China — and potential imposition of tariffs – are likely to impact the PC market this year,” Atwal said.

Following a strong Windows 10 migration among businesses in the second quarter of 2019, Gartner analysts maintain that 75% of the business PC installed base will have migrated to Windows 10 by the beginning of 2021.

“Product managers need to continue promoting the end of Windows 7 support in 2020 as an incentive to migrate to Windows 10,” concluded Atwal.