The worldwide server market continued to grow through 2018 as worldwide server revenue increased 17.8% in the fourth quarter of 2018, while shipments grew 8.5 percent year over year, according to Gartner, Inc. (www.gartner.com) In all of 2018, worldwide server shipments grew 13.1% and server revenue increased 30.1% compared with full-year 2017, according to the research group.

“Hyperscale and service providers continued to increase their investments in their data centers (albeit at lower levels than at the start of 2017) to meet customers’ rising service demand, as well as enterprises’ services purchases from cloud providers,” said Kiyomi Yamada, senior principal analyst at Gartner. “To exploit data center infrastructure market disruption, technology product managers for server providers should prepare for continued increases in server demand through 2019, although growth will be a slower pace than in 2018.”

He added that DRAM prices started to come down, increasing demand for memory-rich configurations to support emerging workloads such as artificial intelligence (AI) and analytics kept buoying server prices. Product managers should market higher memory content servers to take advantage of DRAM oversupplies, according to Yamada.

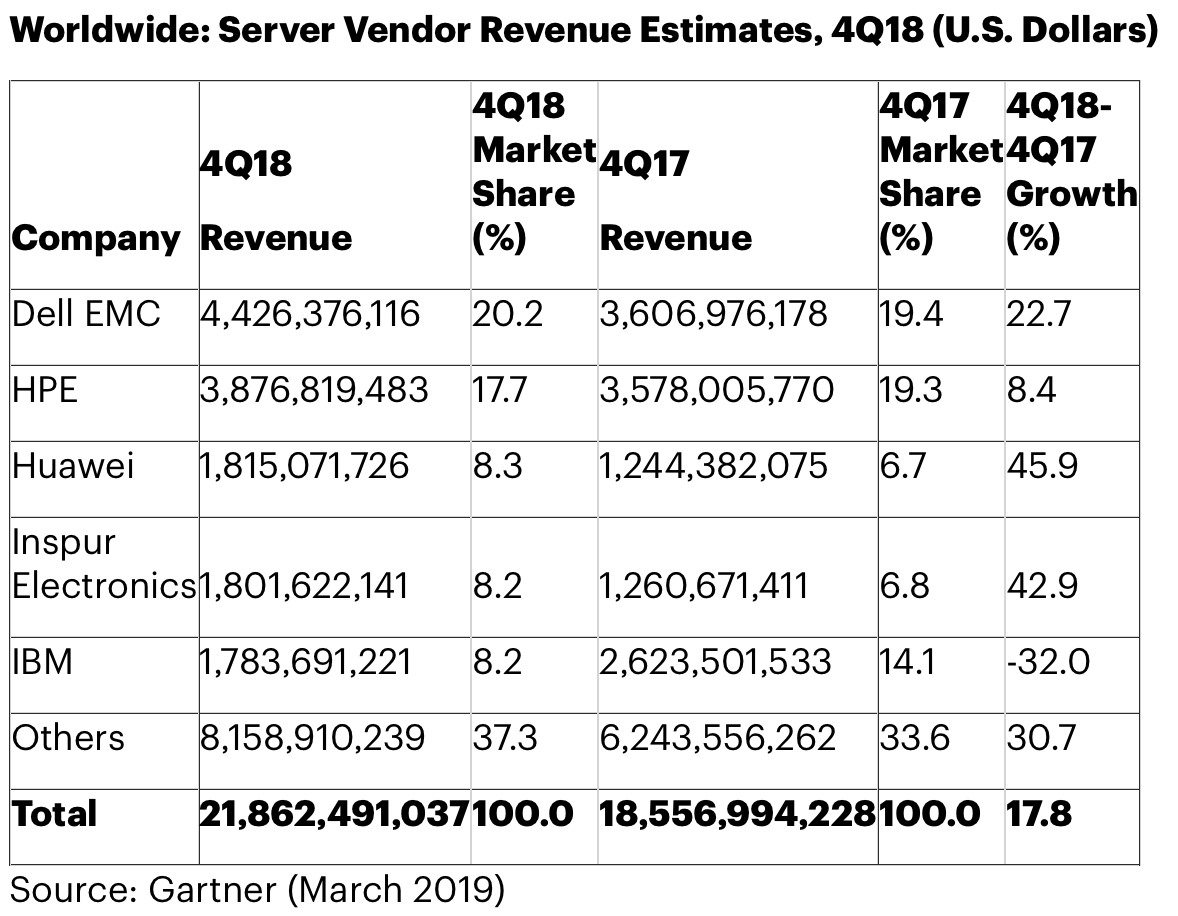

Dell EMC secured the top spot in the worldwide server market based on revenue in the fourth quarter of 2018. Dell EMC ended the year with 20.2% market share, followed by Hewlett Packard Enterprise (HPE) with 17.7% of the market. Huawei experienced the strongest growth in the quarter, growing 45.9%.

In server shipments, Dell EMC maintained the No. 1 position in the fourth quarter of 2018 with 16.7% market share. HPE secured the second spot with 12.2% of the market. Both Dell EMC and HPE experienced declines in server shipments, while Inspur Electronics experienced the strongest growth with a 24.6% increase in shipments in the fourth quarter of 2018.

The x86 server market increased in revenue by 27.1%, and shipments were up 8.7% in the fourth quarter of 2018.