According to a new report from Allied Market Research (www.alliedmarketresearch.com), the global mobile cloud market was pegged at $15.35 billion in 2017 and is expected to garner $74.25 billion by 2023, registering a compound annual growth rate (CAGR) of 30.1% during the period 2017–2023.

Rise in smartphone usage, increase in availability of high-speed network, and surge in adoption of BYOD concept have boosted the growth of the global mobile cloud market, notes the research group. However, security concerns due to increased cyber attacks and lack of interoperability between platforms and operating systems hamper the market growth. On the contrary, rapid technological advancements and increased awareness regarding cloud-based services are expected to create lucrative opportunities for the market players in the near future.

The entertainment segment held the largest revenue in 2017, contributing more than one-third of the total market, owing to high adoption of cloud computing and mobility solutions as it delivers content-rich services to multiple devices effectively, according to Allied Market Research. Moreover, the trend of digitization of media platforms and next-generation smart technologies such as IoT, AI, and machine learning supplemented the segment growth. However, the education segment is projected to manifest the fastest CAGR of 33.3% during the forecast period.

Allied Market Research attributes this to the emergence of massive open online courses (MOOCs), bring your own device (BYOD) concept, mobile e-learning applications and increased influence of mobile cloud learning as it brings the classroom experience to mobile phones of learners and can be remotely accessed and shared with various devices.

The hybrid deployment segment is expected to portray the fastest growth with a CAGR of 30.1% through 2023, owing to rise in demand for efficient productivity by enterprises and quick and secure data access, and high demand from SMEs, according to Allied Market Research. However, the private segment held the largest share in 2017, contributing nearly two-thirds of the total market, owing to growing need of large enterprises to secure confidential data without involving any third-party cloud provider, advancements in IT infrastructure, and maturing channel partner ecosystem.

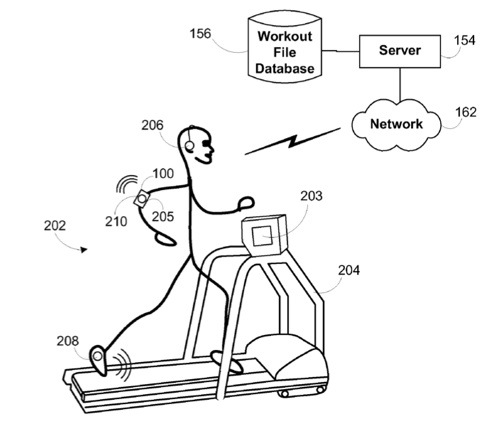

The accompanying image is courtesy of newgenapps.com.