More than 30,000 games have been released in the iPhone App Store since its launch in July 2008, according to the Flurry (http://www.flurry.com). With titles that consistently dominate the Top Paid and Top Grossing lists, there’s no question that the games category is the most lucrative category in the Apple Apple Store, says the research group.

A new Flurry report looks at how Apple has affected the market share of U.S. video game and portable game revenue since the introduction of games sold through the Apple App Store for the iPhone and iPod touch. Using publicly available market data, provided by NPD (mostly through Gamasutra’s Behind the Numbers series), Flurry calculated U.S. console and portable game software sales for 2008 and 2009.

The research group also estimated Nintendo DS and Sony PlayStation Portable game software sales, which make up the significant majority of the portable category, in order to compare these to iPhone game sales. Flurry estimates iPhone game sales using a combination of data made available by Apple and using ratios and calculations from an aggregated set of data that the research group tracks through our analytics service.

Flurry began with a look at the U.S. gaming market, which NPD defines primarily as console and handheld. Computer gaming, which has been declining over the last decade, and is currently approximately 5% of the total U.S. market, is not included. Also, for this analysis, Flurry ignored online gaming revenue (e.g., virtual goods and subscription fees from social networking games and massively multi-player online games).

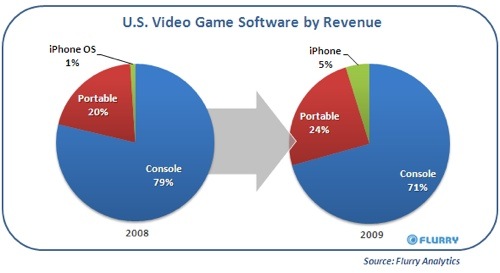

NPD Group shows that combined U.S. console and portable software revenue was approximately US$11 billion and $9.9 billion in 2008 and 2009, respectively. After estimating portable sales, Flurry was able to back into console revenues. The research then added their estimates for iPhone game revenue, detailed later, which total $115 million and $500 million for 2008 and 2009, respectively.

With these figures, Flurry’s main finding is that the iPhone (and iPod touch) is a gaming platform to be reckoned with. Controlling 5% revenue of a $10 billion industry in just a year and a half is significant. From a market share perspective, console games lost ground to portable platforms and iPhone. While the downturn in the economy may have dampened sales of the more expensive console games category, there’s no denying that iPhone has generated substantial revenue and entered strongly into a mature industry.

More interesting to us than iPhone’s impact on U.S. gaming was its impact on the portable category, which Flurry estimates totaled $2.25 billion and $2.55 billion in 2008 and 2009, respectively. Michael Pachter, managing director at Wedbush Morgan Securities and a prominent video game analyst, suggests “iPod touch is the most dangerous thing that ever happened” to game publishers.

As prices come down for the iPod touch, and games sold through the Apple App Store continue to have lower price points, more of the young gaming generation may switch to Apple devices over Sony PSP and Nintendo DS for gaming, says Flurry. Further, Apple has squarely positioned the iPod touch as a gaming machine.

From what the research group calculates, consumers are downloading iPhone games in droves. Comparing iPhone against Sony and Nintendo games sales shows that Apple has taken nearly one fifth of the portable market in 2009, largely at the expense of Sony PSP. With Sony PSP Go, Sony’s latest effort to revive its portable sales, having fallen short of expectations, Sony finds itself now challenged by two competitors in this segment.

Looking forward, with the iPad set for an April release, the traditional gaming giants may yet again be disrupted by Apple. With companies like Electronic Arts and Gameloft joining Apple on stage during its January unveiling of the iPad, the tablet device will enjoy elite game publisher support on day one, says Flurry.

Further considering data that Flurry released in its latest Smartphone Industry Pulse report, where the research group determined that more than one third of iPhone game developers come from the traditional gaming industry, Apple has already established broad third-party game publisher support. With the iPad featuring a larger screen and more processing power, games on the tablet take a step closer to computer and console gaming. Unless the other major video game platform providers (i.e., Sony, Nintendo and Microsoft) respond accordingly, Apple could continue to roll up video game market share, says Flurry.