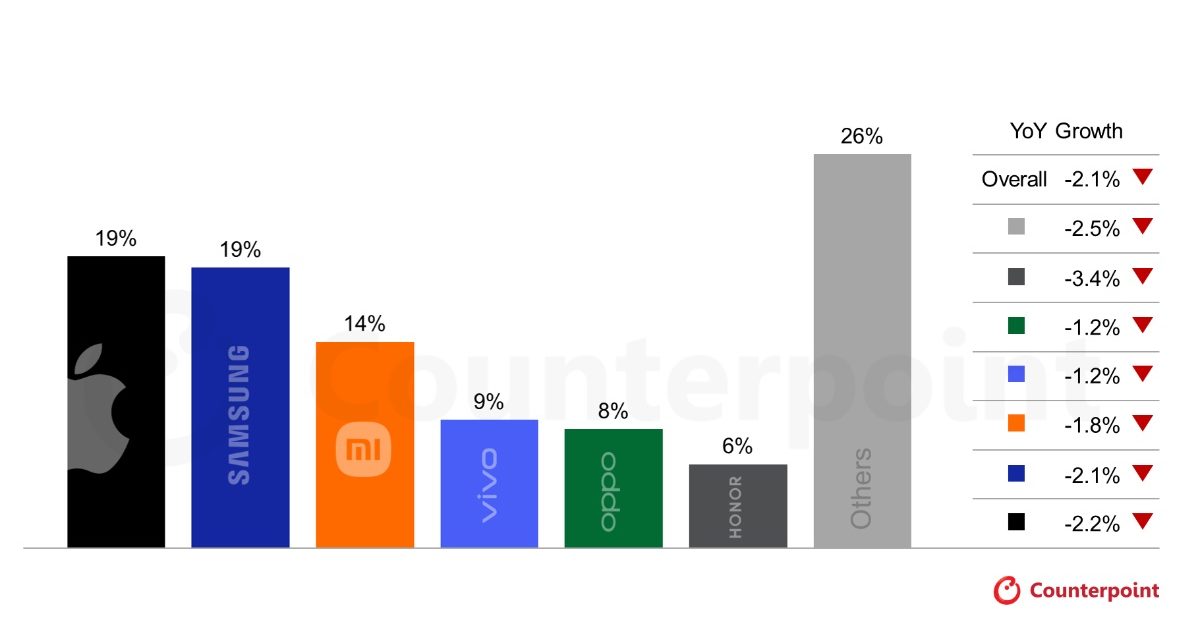

Global smartphone shipments in 2026 are expected to shrink 2.1% due to rising memory costs, according to new data from Counterpoint Research.

However, Apple and Samsung are in the best position to weather the storm, notes the research group. Counterpoint has revised down its 2026 smartphone shipment forecast by 2.6% points. In terms of price bands, the low-end segment is the most impacted, but the impact is being felt broadly.

DRAM price surges have already increased low-, mid- and high-end smartphone bill-of-material costs by around 25%, 15% and 10%, respectively. Counterpoint is expecting further cost impacts in the 10%-15% range through the second quarter of 2026.

Average selling prices (ASPs) have been revised up 6.9% year-over-year (from 3.6% in Counterpoint’s September update) as cost pass-through and portfolio rebalancing move wholesale ASPs higher.

Smartphone makers best positioned to weather supply shortages will be those with scale, broad product portfolios (especially at the high end) and tight vertical integration, notes the research group.

“Apple and Samsung are best positioned to weather the next few quarters,” said Counterpoint Senior Analyst Yang Wang. “But it will be tough for others that don’t have as much wiggle room to manage market share versus profit margins. We will see this play out especially with the Chinese OEMs as the year progresses.”

I hope you’ll help support Apple World Today by becoming a patron. Almost all our income is from Patreon support and sponsored posts. Patreon pricing ranges from $2 to $10 a month. Thanks in advance for your support.

Article provided with permission from AppleWorld.Today