Global smartphone shipments are expected to increase by 3.3% year-over-year in 2025, mainly driven by strong performances from Apple, according to new data from Counterpoint Research.

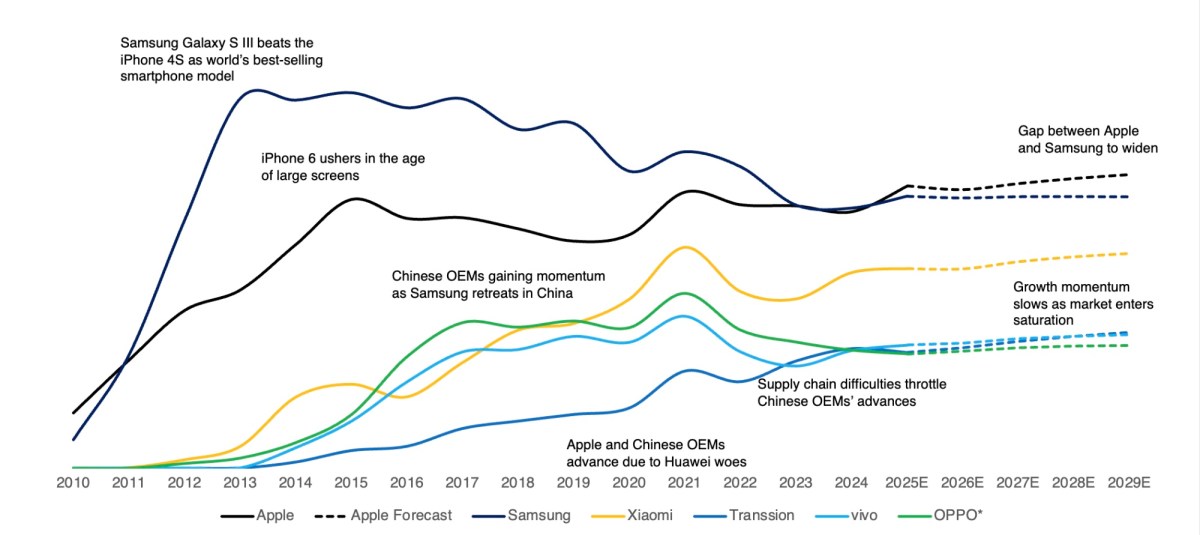

The iPhone maker is set to dethrone Samsung in shipments for the first time in 14 years and will maintain the top spot through 2029, according to the research group. With strong momentum building for the iPhone 17 series across key regions, iPhone shipments are predicted to grow 10% year-over-year (YoY) in 2025.

“We are tracking double-digit growth for both China and the US in October,” Counterpoint says.

iPhone shipments exceeded expectations in quarter three of 2025, posting a solid 9% YoY growth for the quarter. The launch of the iPhone 17 series marked a shift in Apple’s usual lineup, with the new iPhone Air replacing the Plus model, accompanied by adjustments in memory configurations and pricing tiers.

Counterpoint’s latest “high-frequency data” points toward bumper holiday season sales for iPhones.

According to Counterpoint’s latest Weekly Sell-Through Tracker, sales of the iPhone 17 series in the US, including the iPhone Air, during the first four weeks after launch were 12% higher than those of the iPhone 16 series, excluding the iPhone 16e.

In China, sales of the iPhone 17 series during the same period were 18% higher than its predecessor, even though the Air model was not part of the initial launch. In Japan, sales for the iPhone 17 series during the first four weeks were 7% higher than those for the previous generation.

Commenting on the bullish outlook for Apple, Senior Analyst Yang Wang said, “Beyond the highly positive market reception for the iPhone 17 series, the key driver behind the upgraded shipment outlook lies in the replacement cycle reaching its inflection point. Consumers who purchased smartphones during the COVID-19 boom are now entering their upgrade phase. Furthermore, 358 million second-hand iPhones were sold between 2023 and Q2 2025. These users are also likely to upgrade to a new iPhone in the coming years. These factors will form a sizable demand base, which is expected to sustain iPhone shipment growth over the coming quarters.”

Elsewhere, Apple also benefited from lower-than-expected tariff impacts globally and a truce in the US-China trade and tech war. Wang says this not only helped Apple’s supply chain and the ongoing efforts to diversify manufacturing bases, but also aggregate demand in its key growth regions, i.e. emerging markets. Appreciating domestic currencies versus the US dollar and a resilient economic outlook boosted consumer confidence. With these structural tailwinds, Apple is well-positioned to surpass Samsung in annual shipments in 2025.

Apple is on track to launch the iPhone 17e, the successor to the iPhone 16e and the second model in the “e” series, in the first half 2026. The company is also expected to release its first foldable iPhone by the end of the same year, with the first flip iPhone expected by late 2027.

With shipments rebounding and even higher-priced foldables being launched, Apple is also expected to remain the top revenue contributor in the global smartphone market through the end of the decade, according to Counterpoint.

“By expanding its lineup across multiple price tiers, including the growing ‘e’ series, and potential adjustments to the Pro and Base launch cycles, Apple is strategically positioning itself to capture rising demand from aspirational consumers, particularly in emerging markets, and to strengthen its presence in the lower premium segment, which is projected to grow faster than the overall market,” the research group adds.

I hope you’ll help support Apple World Today by becoming a patron. Patreon pricing ranges from $2 to $10 a month. Thanks in advance for your support.

Article provided with permission from AppleWorld.Today