Apple Savings account holders are receiving push notifications informing them that Goldman Sachs has raised the interest rate on the account to 4.25% from 4.15%.

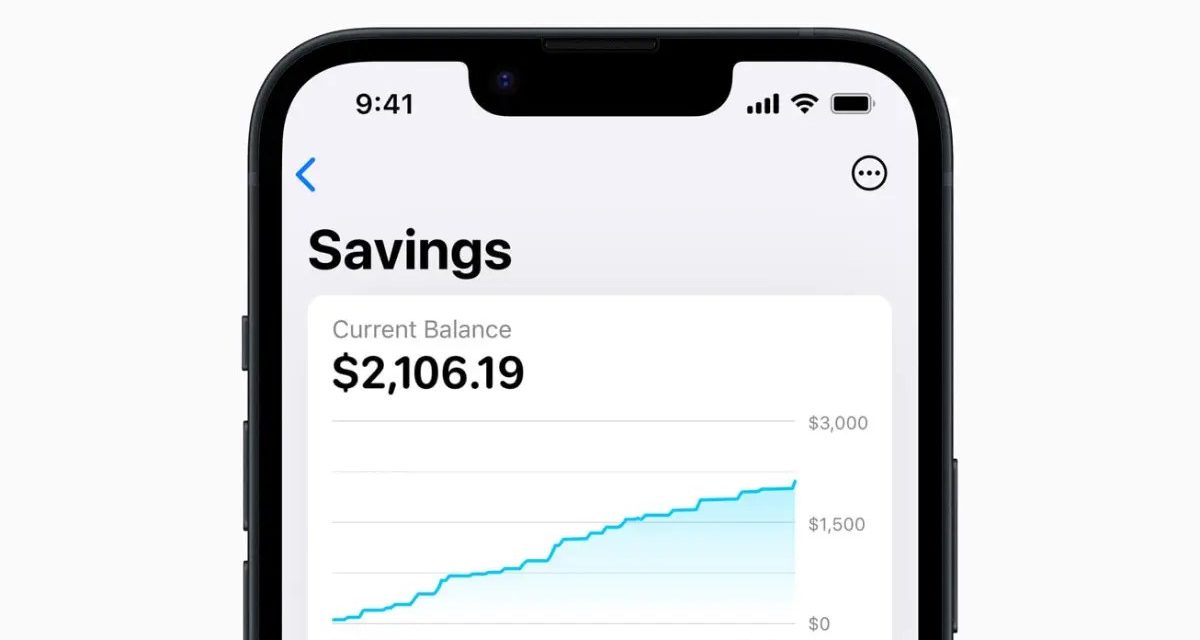

With Apple Savings, Apple Card users will be able to open the new high-yield Savings account and have their Daily Cash automatically deposited into it — with no fees, no minimum deposits, and no minimum balance requirements. Users can spend, send, and save Daily Cash directly from Wallet.

“Savings enables Apple Card users to grow their Daily Cash rewards over time, while also saving for the future,” Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet, said in a press release in October 2023 “Savings delivers even more value to users’ favorite Apple Card benefit — Daily Cash — while offering another easy-to-use tool designed to help users lead healthier financial lives.”

She said Apple Card users can easily set up and manage Savings directly in their Apple Card in Wallet. Once users set up their Savings account, all future Daily Cash received will be automatically deposited into it, or they can choose to continue to have it added to an Apple Cash card in Wallet. Users can change their Daily Cash destination at any time.

To expand Savings even further, users can also deposit additional funds into their Savings account through a linked bank account, or from their Apple Cash balance. Users can also withdraw funds at any time by transferring them to a linked bank account or to their Apple Cash card, with no fees.

As for the Apple and Goldman Sachs relationship, that looks to be coming to an end. On November 29, The Wall Street Journal reported that Apple plans to stop working with Goldman Sachs in the next 12 to 15 months, and it it’s unknown if the company has established a new partnership for its Apple Card.

And in October it was reported that Goldman Sachs bank wants out of its consumer lending deal with Apple as soon as possible. When Goldman Sachs and Apple launched their joint savings account in April, Goldman held a town hall at its headquarters, where bank execs talked it up. However, one exec had a different message shortly afterwards: “We should have never done this f___king thing,” he told colleagues, according to the WSJ.

Article provided with permission from AppleWorld.Today