According to a mew report from International Data Corporation (IDC) worldwide converged systems market revenue increased 9.9% year-over-year to $3.5 billion during the second quarter of 2018 (2Q18).

“Datacenter infrastructure convergence remains an important investment driver for companies around the world,” says Sebastian Lagana, research manager, Infrastructure Platforms and Technologies at IDC. “HCI solutions helped to drive second quarter market expansion thanks, in part, to their ability to reduce infrastructure complexity, promote consolidation, and allow IT teams to support an organization’s business objectives.”

IDC’s converged systems market view offers three segments: certified reference systems & integrated infrastructure, integrated platforms, and hyperconverged systems.

The certified reference systems & integrated infrastructure market generated $1.3 billion in revenue during the second quarter, which was a year-over-year decline of 13.9% and represented 38.1% of total converged systems revenue. Dell Inc. was the largest supplier in this market segment with $639.8 million in sales and a 47.5% share. Cisco/NetApp generated $481.0 million in sales, representing the second largest share of 35.7%. HPE generated $108.4 million in sales, representing 8.1% market share.

Integrated platforms sales declined 12.5% year-over-year during the second quarter, generating revenues of $729.4 million. This amounted to 20.7% of the total converged systems market revenue. Oracle was the top-ranked supplier of integrated platforms during the quarter, generating revenues of $440.6 million and capturing a 60.4% share of this market segment.

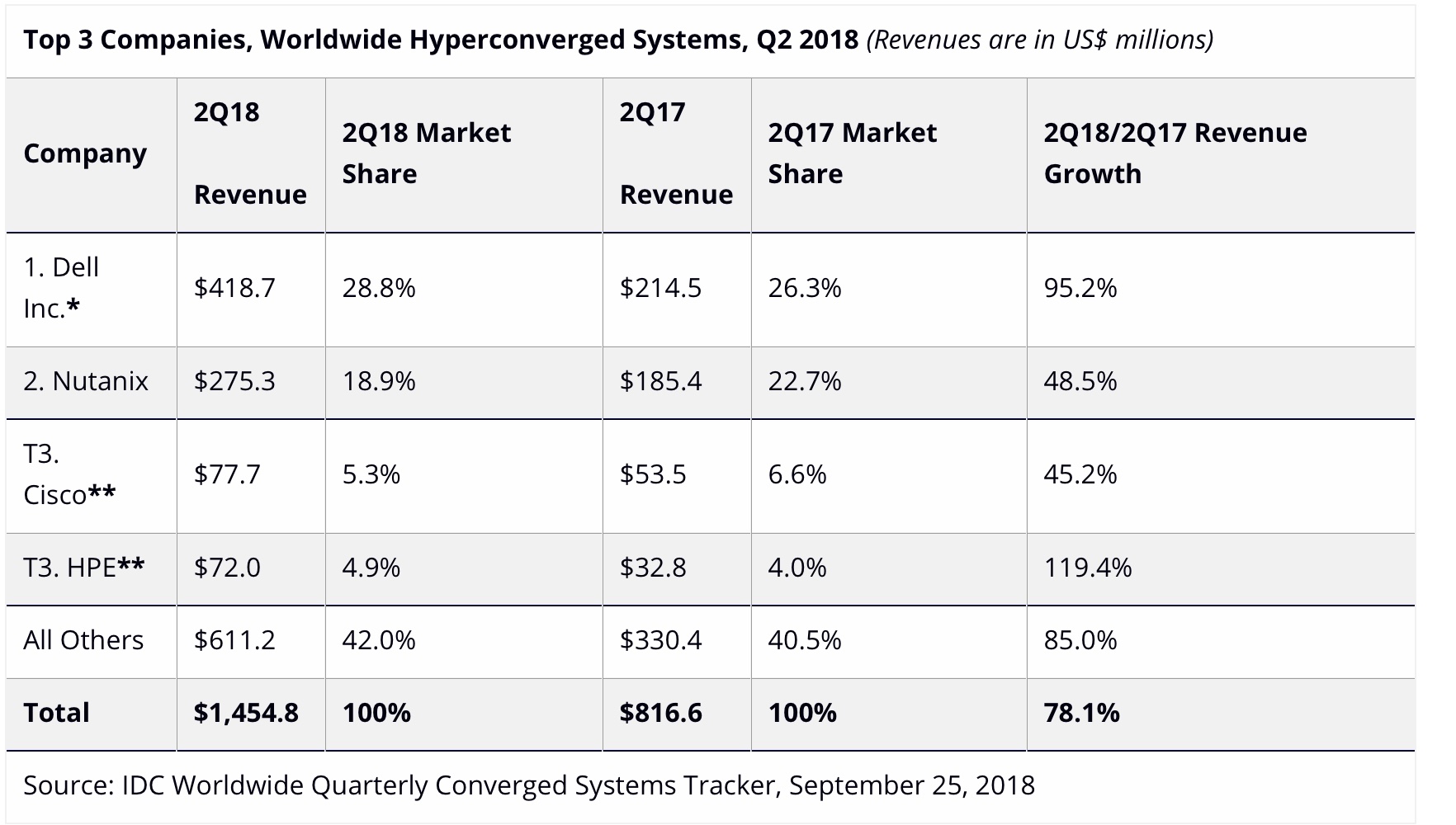

Revenue from hyperconverged systems sales grew 78.1% year-over-year during the second quarter of 2018, generating $1.5 billion worth of sales. This amounted to 41.2% of the total converged systems market.

As it relates to the branded view of the hyperconverged systems market, Dell was the largest supplier with $418.7 million in revenue and a 28.8% share. Nutanix generated $275.3 million in branded revenue with the second largest share of 18.9%. Cisco and HPE were statistically tied for the quarter, with $77.7 million and $72.0 million in revenue, or 5.3% and 4.9% in market share, respectively.