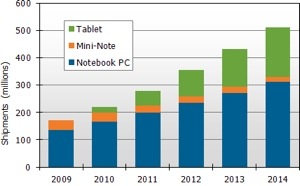

Mobile computer shipment momentum is slowing, from 30% year-over-year growth in 2010, to 27% in 2011, when the market will reach 277.7 million units, according to the DisplaySearch Quarterly Mobile PC Shipment and Forecast Report” (http://www.displaysearch.com).

Decline in mini-note shipments and emerging regions is slowing growth, but notebook and tablet growth in mature markets is buoying the overall market, according to the research group. Shipment growth is expected to slow in the short term as compared to previous forecasts but pick up longer term, as emerging markets return to contributing at the high rates they have seen over the last several years.

Shipments into mature markets are expected to rise in the short to medium term with increasing demand from tablet computer shipments and a commercial market computer refresh cycle, says DisplaySearch. Shipments into North American are expected to reach 91 million units in 2011 and 108.6 million units in 2012.

“Two of the main drivers for mobile computer shipment growth over the last few years are expected to sputter in 2011: mini-notebooks and emerging markets,” says Richard Shim, mobile computing analyst for DisplaySearch. “Only one of these segments is expected to bounce back. The mini-note market is falling rapidly as brands are looking to exit the mini-note segment and invest in the latest high-growth segment, tablet computers.”

Mini-note shipment growth is dropping, down almost 20% year-over-year, to 25.4 million units in 2011. Mini-notebooks will continue to remain a segment of the market, but it will be for price-sensitive areas, such as emerging markets and education, according to DisplaySearch.

As expected, tablet shipments in the first half of 2011 will experience a hitch as competitors struggle to determine how best to market, sell and create demand for their initial offerings, while facing tough comparisons to the incumbent, Apple. By the second half of 2011, DisplaySearch expects the market needs and segmentation to be clearer, enabling a resumption of rapid growth.

Despite the turbulence, tablet shipments are expected to reach 52.4 million units in 2011 with shipments into mature markets remaining strong, but weakening in emerging regions. Consumers in emerging regions continue to search for performance-oriented computers and are tending to prefer notebooks over convenience-oriented tablets.

Tablets will be a vital contributor to overall mobile computer shipment growth, but notebooks will remain the largest segment of the mobile market. The 20% year-over-year shipment growth rate of notebooks combined with the over 150% year-over-year shipment growth rate of tablets will result in healthy double-digit growth for mobile computers in 2011 and throughout the forecast period, according to DisplaySearch.