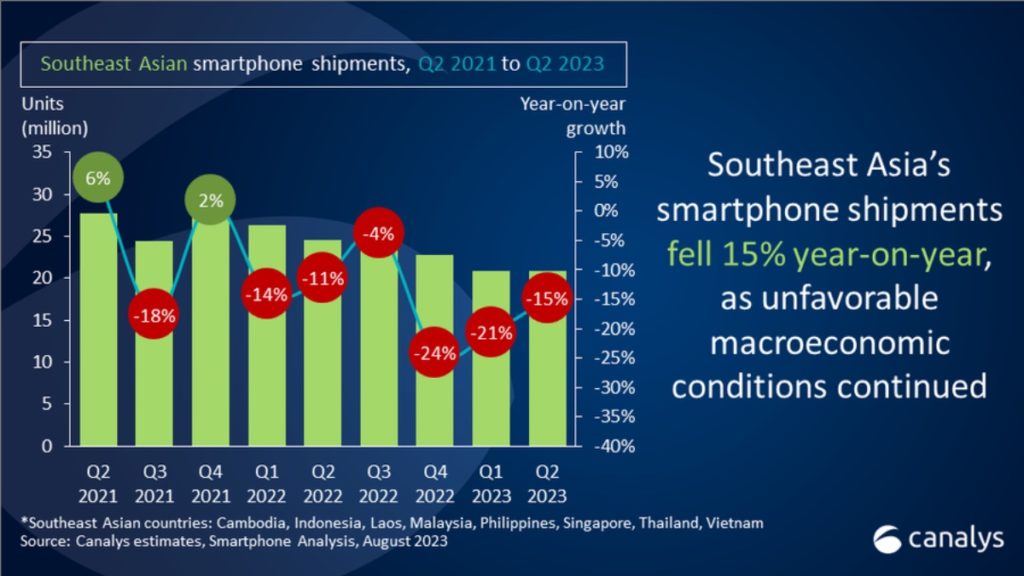

The Southeast Asia smartphone market fell 15% year-on-year in quarter two (Q2) 2023 to 20.9 million units, the lowest shipment since 2014, as the unfavorable macroeconomic conditions continued, according to the Canalys research group.

Apple isn’t among the top 10 smartphone manufacturers in the region, though the iPhone’s popularity is growing a bit. Despite a year-on-year decline of 26%, Samsung maintained its lead in Southeast Asia, shipping 4.2 million units, gaining 20% market share, driven by its new A-series models.

OPPO maintained its second position by shipping 3.4 million units and capturing a 16% market share. Xiaomi and Transsion both shipped 2.9 million units, each gaining 14% market share respectively. realme reclaimed the fifth spot, shipping 2.6 million units and capturing a 12% market share as it saw success with its new C-series launches.

According to Canalys Le Xuan Chiew, Apple increased channel incentive efforts as it faced challenges in calibrating its inventory of non-pro iPhone 14. Canalys expects mid-single-digital growth for Southeast Asia’s smartphone market in 2024.

Article provided with permission from AppleWorld.Today