The global premium smartphone market (models priced US$400 and above) recorded a 46% year-over-year sales growth in the second quarter of 2021, according to Counterpoint Research’s Market Pulse Service. And Apple’s iPhone dominated.

The growth in the premium segment outpaced the overall market growth of 26% year-over-year, according to Counterpoint Research. Besides, the premium segment share in the global smartphone sales increased to 24% in quarter two of 2021, compared to 21% in quarter two of 2020.

Apple’s dominance

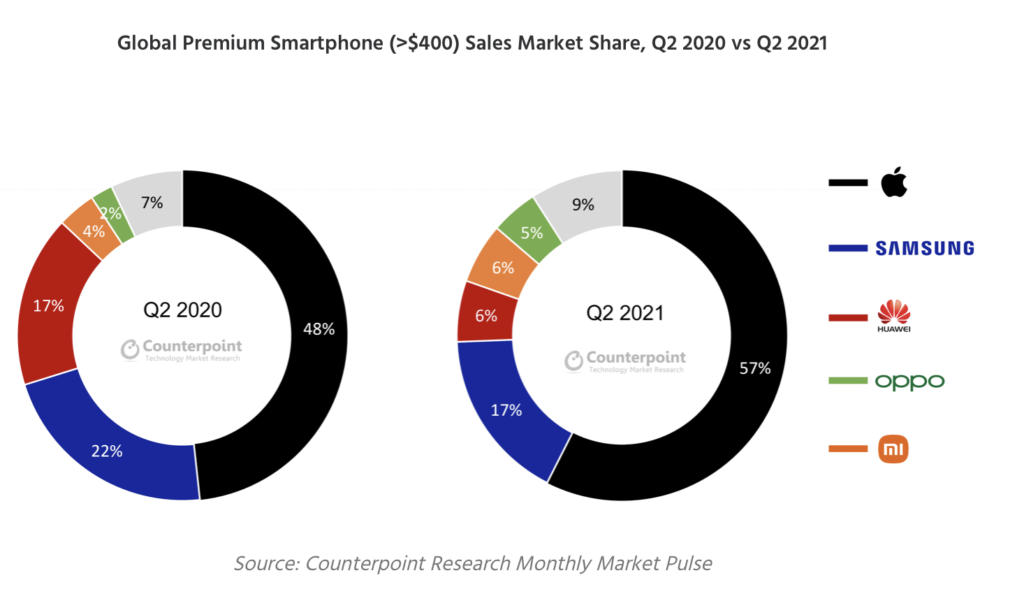

Apple continued to lead the segment, cornering over half of the sales during the quarter, followed by Samsung and Huawei. Since the launch of iPhone 12 series in the fourth quarter of 2020, Apple has continued to account for over 50% share in the premium smartphone market.

A large part of the premium market growth in quartet two of 2021 was driven by Apple, which reported a sales growth of 74% year-over-year in the premium segment on the strong momentum of the iPhone 12 series due to the iPhone users continuing to upgrade to 5G. Counterpoint says Apple’s supply chain was also very resilient in managing component shortages and gained from the decline of Huawei in regions like China and Europe. The tech giant was the largest smartphone manufacturer in the premium segment across all regions, notes the research group.

Ultra-premium segment growth

Within the premium segment, while all the price bands saw growth, the highest growth (182% year-over-year) was seen in the ultra-premium band (>$800). This was mainly due to the strong momentum of the iPhone 12 Pro Max and iPhone 12 Pro, notes Counterpoint.

The Pro versions were launched later than the usual September date, causing demand to spill over to the subsequent months. Apple captured close to 75% of the ultra-premium segment, compared to 54% a year ago.

Counterpoint says this shift also indicates that more consumers now prefer high-end devices after realizing the importance of smartphones to them during the COVID-19 lockdowns. A section of consumers also had extra savings while working from home, which they invested in devices like smartphones.

The effects of 5G

The research group says 5G is also becoming a standard offering within the premium segment. The overall penetration of 5G within the premium segment reached 84% in quarter two of 2021, compared to 35% in quarter two of 2020. In the $600 and above price band, 95% of devices were 5G capable. The launch of the iPhone 12 series in quarter four of 2020 gave a boost to the sales of 5G capable devices in the segment.

Looking ahead

Going forward, Counterpoint says the premium segment is likely to continue its growth momentum. The sales of the iPhone 12 have been very stable in markets like the US even before the launch of the new iPhone series this month. What’s more, the launch of the Fold series from Samsung and the refresh of iPhones by Apple will also drive growth, adds the research group. With the replacement cycle for iPhone being closer to three years, there is also a significant potential of 5G upgrades in 2021 and beyond.

Article provided with permission from AppleWorld.Today