HYLA Mobile, a provider of software technology and services for mobile device returns management and reuse solutions, has revealed the delayed impact of the COVID-19 pandemic on U.S. trade-in programs.

According to HYLA’s Q2 2020 trade-in trends research, US$225 million was returned to U.S. consumers as part of trade-in programs. That’s a 50% decrease from the same quarter last year. Although HYLA’s data typically shows a seasonal dip in quarter two from quarter one by about 15%, this year saw a 57% decrease.

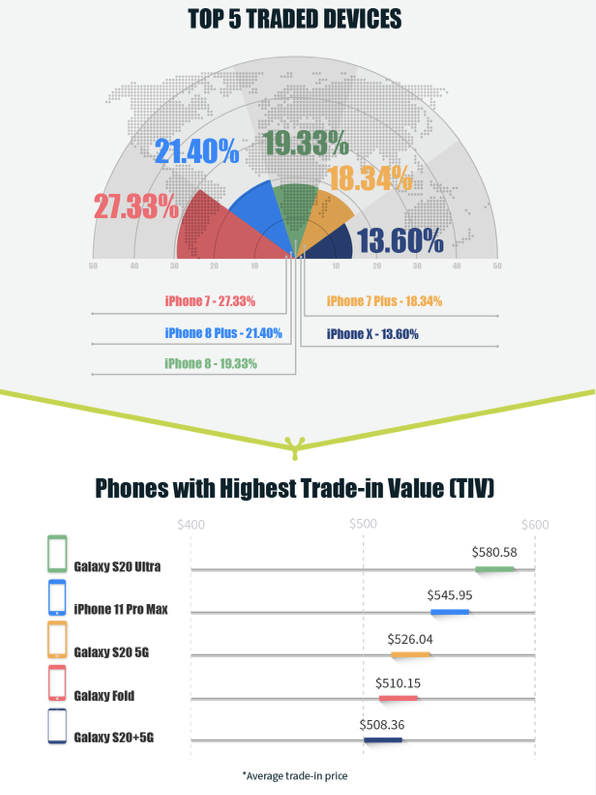

While U.S. operators, original equipment manufacturers and retailers have facilitated fewer trade-ins owing to store closures and shutdowns, their values have stayed strong. The average price of a smartphone at trade-in has increased by 9% from $102.25 in quarter one, to $111.47 in quarter two. What’s more, the highest trade-in value for a device recorded during the second quarter was $580.58, while the highest trade-in value recorded in quarter one was $560.97.

“In quarter one, as the virus spread across the world, the secondary device market maintained its high demand. But our data now reveals the significant impact the pandemic has had on the smartphone market,” says Biju Nair, president and CEO of HYLA. “Due to sustained demand for pre-owned devices, their value is rising. Operators, original equipment manufacturers and retailers need these devices to service their insurance programs and emerging markets need more affordable, high-quality devices.”

HYLA releases data on mobile device trade-in trends in North America on a quarterly and annual basis. By combining live market data with data from its analytics platform, it reveals trends on the trade-in value of devices, the top traded smartphones, as well as the average age of smartphones at the point of trade-in.

Key findings from HYLA’s quarter two trade-in trends data include:

° The top traded device in quarter one was the iPhone 7, followed by the iPhone 8 Plus, iPhone 8, iPhone 7 and the iPhone X, which made its first appearance in the top five traded devices. The top five traded devices accounted for half of all traded devices during the quarter.

° The Samsung S7 was the most traded Samsung device in quarter two and has been the top traded Samsung device since quarter one 2018. The iPhone 7 was the top traded iPhone for the sixth consecutive quarter.

° This was the first quarter that variations of the iPhone 6 haven’t featured in the top five traded devices since quarter one of 2016.

° The Galaxy S20 Ultra received the highest trade-in value of $580.58 at trade-in. In the three months since its launch, the device has depreciated by 59%.

° The average age of a smartphone at trade-in continues to rise. The average age of an Android device was 3.13 years, up from 3.07 years in quarter one. The average age of an iPhone at trade-in was 3.25 years (up from 3.17 years in quarter one 2020), while the average age of an Android smartphone was 2.75 years (down from 2.77 in quarter one 2020).

° Online device trade-ins increased 66% over the same period last year and 172% over quarter one of this year.