Consumer Intelligence Research Partners has released results from its research on ride sharing services, including Uber Technologies and Lyft for U.S. consumers of these services as of Dec. 31, 2019.

Based on this research, CIRP continues to find overlap between Uber and Lyft riders. Uber riders prefer it because of availability of rides and longer experience with the service, while Lyft riders prefer it because of lower cost.

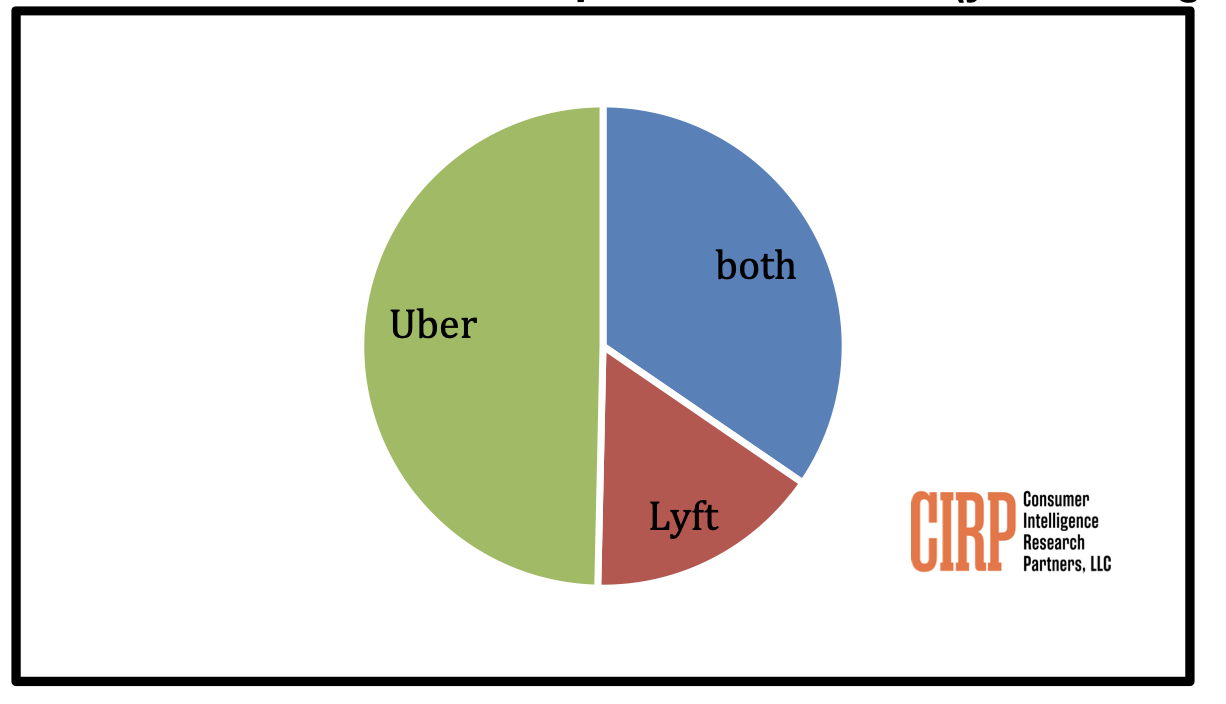

CIRP analysis indicates that Uber has the dominant U.S. market share, with 85% of riders using Uber at least once in the three months prior to survey in the year ending December 31, 2019, compared to 50% for Lyft.

“Uber continues to have a dominant market share in the U.S.,” said Josh Lowitz, partner and co-founder of CIRP. “In 2019, 85% of rideshare customers we surveyed used Uber in the past three months, and 50% of riders used only Uber. In contrast, 50% of riders used Lyft, and 16% used only Lyft. The almost 35% of riders that used both represents significant overlap, even after several years of competing fiercely with each other. Though Uber has a significantly larger share now, the substantial percentage of riders that use both services suggests that the market is far from settled.”

Uber riders choose it as their first choice for a range of reasons, including availability of rides, more experience with the service, and better customer service. Lyft riders choose it as their first choice primarily because of lower cost.

“Uber and Lyft riders have very different reasons for choosing one service over the other,” said Mike Levin, partner and co-founder of CIRP. “Lyft riders choose it overwhelmingly because of perceived or actual lower cost. In contrast, Uber riders say they choose it because of availability of rides, and because they have used Uber for longer and it’s more familiar. Lyft may continue to compete on price, trying to make inroads against Uber with its longer history and perceived greater availability of drivers. While brand identity can change, Lyft and Uber seem to have begun to establish individual identities based on cost and convenience.”

CIRP bases its findings on its surveys of 2,000 US users of Uber and Lyft, surveyed during 2019, who used Uber, Lyft, or both ride sharing services in the three months preceding the surveys.