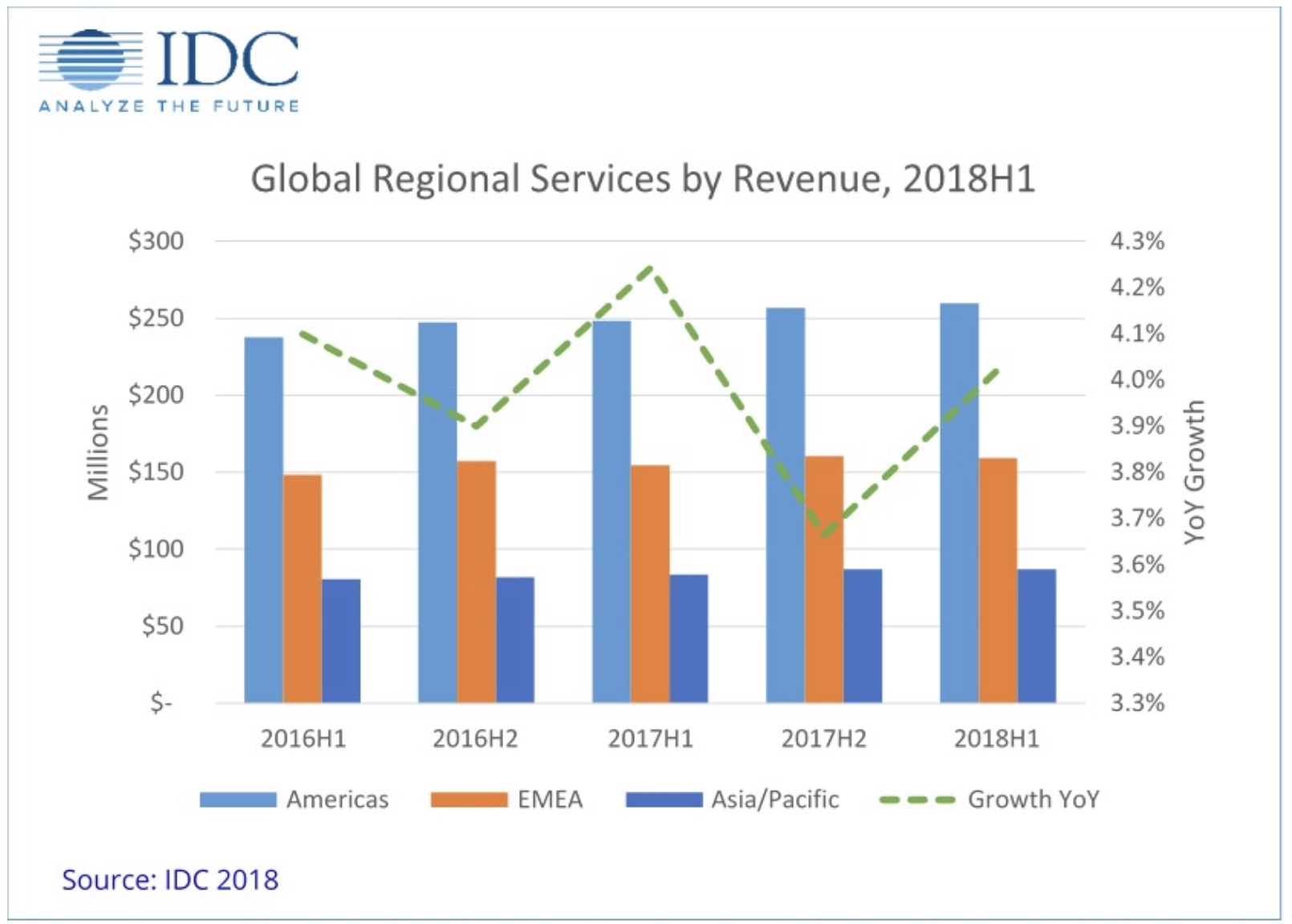

Worldwide revenues for IT Services and Business Services totaled $506 billion in the first half of 2018 (1H18), an increase of 4% year over year (in constant currency), according to the International Data Corporation (IDC) Worldwide Semiannual Services Tracker.

This growth reflects a relatively sanguine economic outlook during the first half of this year with accelerated digital transformation and, in some pockets, new digital services offsetting the cannibalization of traditional services, notes the research group.

During 1H18, it was a mixed picture for tier-one global outsourcers/integrators (companies with full service offerings and more than $10 billion in services revenue) headquartered in developed countries: most remained flat or declined slightly (organic growth in constant currency). But this was partially offset by stronger performances by two large global vendors, who returned to double-digit growth in the teens, according to IDC.

While most Indian services providers still outpace their U.S. and European counterparts, their growth (organic, in constant currency) scaled back slightly from a year ago, continuing their 2H17 deceleration. Growth paths continued to widen between vendors: while most large Indian vendors continued to grow at rates in the low single digits to high teens, it was offset by a few vendors’ sharp slowdown.

IDC says this is partially attributed to restructuring leadership teams and divesting business units to improve margins. It should also be noted that foreign exchange fluctuations in 2018 have complicated the constant currency calculations somewhat.

Looking at the different services markets, project-oriented revenues grew by 5.2% in 1H18 to $191 billion, followed by 3.6% growth for managed services and 2.7% for support services. The above-the-market growth in project-oriented markets was mostly led by business consulting and application development markets with growth rates of 7.5% and 6.5%, respectively.

Most major management consulting firms still posted strong earnings in 2018, although growth rates cooled slightly: business consultants still extract more value in digital transformation. But the market movement belies enterprise buyers going from “thinking digital” to “doing digital.”

For example, the heavy lifting of digital is ultimately reflected in application projects, and the application development market showed faster growth in 2018 than both 1H17 and 2H17. As services vendors are making agile and cloud the central themes in their app businesses, it has helped them to shorten sales cycles and ramp up new app work.

In outsourcing, revenues grew 3.6% to $238 million in 1H18. Application-related managed services revenues (hosted and on-premise application management) outpaced infrastructure and business process outsourcing. Organizations rely largely on outsourcers to supply new app skills at scale.

Large outsourcing contracts also served as the best vehicle to standardize and modernize existing application assets. Therefore, IDC expects application-related managed services markets to continue outgrowing other outsourcing markets in the coming years.

On the infrastructure side, while hosting infrastructure services revenue accelerated to 7.2% growth in 1H18, mostly due to cloud adoption, IT Outsourcing (ITO) – still almost twice as large a market and mostly big buyers and vendors – declined by 1.5%, largely chipped away by cloud cannibalization across all regions.