New data from the Parks Associates (www.parksassociates.com) research group says 37% of U.S. broadband households regularly use transactional services for OTT [over the top] video, such as online video rentals and downloads.

The vast majority of consumers making these a la carte purchases also have a streaming video subscription, emphasizing the potential role of transactional services to supplement subscription OTT. For example, approximately two-thirds of Amazon Instant Video subscribers also rent or purchase titles through the service, and their average expenditures are increasing. By contrast, expenditure on downloads among Netflix subscribers is decreasing.

“Subscription services are the most popular form of OTT video, but a transactional service that offers a wide selection of titles and easy-to-use controls can score with consumers and create new revenues,” says Barbara Kraus, director, research, Parks Associates. “However, the lack of content can be the death knell for a service. Verizon and Redbox ended the Redbox Instant service this week, which failed in large part because only a limited number of titles were available to rent through its streaming library. What the service needed was a large selection of online titles, with easy access for streaming.”

Parks Associates research also reveals the type of CE platform in use can influence money spent on transactional OTT purchases, a trend Amazon is looking to exploit with its Amazon Fire TV streaming devices. The firm’s 360 View: CE Adoption and Trends, which includes data and analysis of a 1Q 2014 consumer survey of 10,000 U.S. broadband households, finds that among frequent users of streaming media players, 80% pay for monthly streaming services, such as Netflix, but also nearly 30% stream video rentals and 20% buy video to stream.

These users are U.S. broadband households with Internet-connected CE that use a streaming media player such as Roku or Apple TV more frequently than any other device.

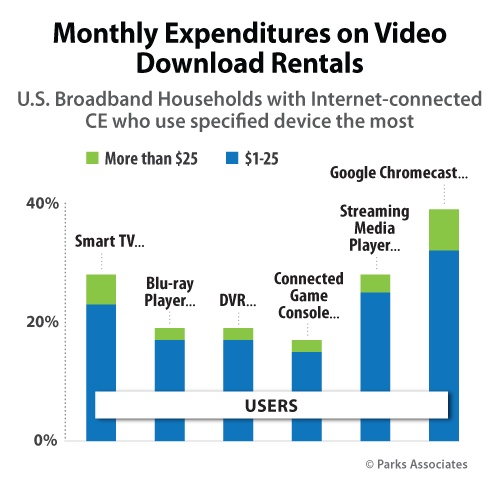

“Among frequent smart TV users, nearly 30% download video rentals, while 40% of users who favor the Google Chromecast rent video downloads each month,” Kraus said. “There is a core set of users for all CE devices who are paying for video rentals and purchases. Ease-of-use is the key factor driving most households to use a certain device, so developing a rental or download content service that is simple and well integrated with a device’s UI could help increase a la carte revenues among streaming content.”

360 View: CE Adoption and Trends also shows that 23% of most-frequent smart TV users spend up to $25 a month on video download rentals, while 22% buy video downloads. Among frequent users of connected Blu-ray players, 17% spend up to $25 a month to rent videos, and 12% buy video downloads.