Market research firm Infonetics Research has released excerpts from a Mobile Spectrum market size and forecast report, which analyzes radio frequency spectrum allocation and needs in the world’s top economies.

“Seven years ago the ITU predicted the world would need twice as much radio frequency spectrum as is allocated now, and that was even before the advent of the data-hungry iPhone,” reports Stéphane Téral, principal analyst for mobile infrastructure and carrier economics at Infonetics Research. “But if the ITU forecast had held true, all mobile networks with significant mobile broadband usage would have crashed by now.”

HSPA+ and LTE are two of the primary reasons operators have been able to squeeze more and more bits out of limited spectrum, Téral adds. HSPA/HSPA+ and LTE improve spectral efficiency so significantly that the need for spectrum has been greatly reduced, often by at least half. LTE technology is not only resistant to interference between cells but also spreads transmission efficiently over available spectrum.

“Our mobile spectrum report explores additional techniques operators are using to optimize their cellular resources without adding more spectrum and provides an alternative view to the mainstream belief that there is not enough spectrum,” Téral says.

Wi-Fi offload may also be helping ease the spectrum crunch: Some mobile operators report to Infonetics that up to 75% of mobile device data traffic is on WiFi Despite the ubiquity of HSPA and EV-DO, average mobile connection speeds remain low, below 4Mbps on average in the 16 countries included in Infonetics’ analysis

Russia has the highest average (4.1 Mbps) and peak (21 Mbps) mobile connection speeds, mainly because it has one of the world’s best mobile networks but relatively few 3G subscribers and low Internet usage. The U.S. leads the global mobile broadband race when it comes to number of LTE subscribers, accounting for just over half of the world’s 64 million LTE subscribers

Countries with heavy mobile broadband usage such as the US, South Korea, and Japan are on track to need 1,000 MHz of spectrum by 2017. Indonesia, the 3rd largest population on earth, has the potential to be the “new China” in terms of mobile growth opportunities; however, the country has been slow to enable mobile broadband and open up 3G spectrum.

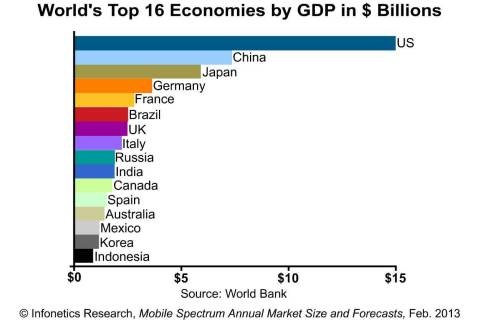

Infonetics’ new mobile spectrum report provides market size, forecasts, analysis, and trends for mobile spectrum in the world’s 16 largest economies (according to the World Bank): The United States, Canada, Japan, Germany, France, Brazil, United Kingdom, Italy, Russia, India, Canada, Spain, Australia, Mexico, South Korea, and Indonesia. The report also features a 3G and 4G Spectrum Auctions Tracker following 65 countries by region, status, and scheduled deployments. To buy the report, Infonetics at http://www.infonetics.com/contact.asp .