Crowd Technologies, the provider of the stock research site Piqqem, has announced the sentiment results (http://www.piqqem.com/equities/aapl) for Apple Computer going into their earnings announcement on Tuesday, July 20. The company says sentiment for Apple has dropped 15 points to the lowest level in the past 15 months.

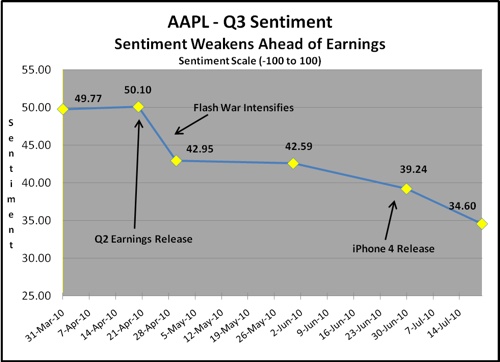

Piqqem’s quarterly chart shows Apple’s sentiment dropping by 15 points from the beginning of the quarter through today. In comparison, sentiment for the Piqqem Technology Index rose two points in the same period, which means Apple’s decreasing sentiment was not strongly influenced by market forces. On the Piqqem scale, Apple’s sentiment rating of 34.60 is still considered positive and indicates a quality stock.

Apple has consistently been a top three rated company on Piqqem’s top rated list and now doesn’t appear in the top 25. At its peak, Apple had a sentiment rating of 58 at the beginning of the year. Is there any rational for the drop?

In analyzing the sentiment line, Piqqem identified two primary issues. On April 29 CEO Steve Jobs wrote his open letter regarding the state of Flash from Apple’s perspective and this corresponded to a seven-point drop in Apple’s sentiment. On June 24, Apple released the iPhone 4 which received some bad reviews and this corresponded to another 5 point drop in sentiment. As of now, both of these events remain more of a PR issue and Apple’s briefing last week about the iPhone 4 should put the company back on track, according to Crowd Technologies.

Average analyst estimates for the iMac and iPhone giant are US$3.10/share in EPS [earnings per share] and $14.74 billion in revenue. Forty analysts track the stock with 15 upward EPS revisions in the last 30 days and no downward EPS revisions in the last 30 days. The 15 upward revisions is a real vote of confidence for the expected performance in the third quarter, according to Crowd Technologiges. Last quarter, Apple beat average analyst expectations by $.88 per share, $3.33/share vs. $2.45 per share. Apple’s share price also remains strong with Friday’s close of $249.90 being at 78% of its 52 week price range.

Apple is also part of the Piqqem Technology Sentiment Index, which tracks sentiment for 28 technology stocks in the Hardware & Networking, Software & Gaming, Internet & Mobile, and Semiconductor Sectors. Apple is part of the hardware and networking sector and it has shown growing strength and remains the strongest of the four technology sectors. So this is positive for Apple, says Crowd Technologies.

The financial analysts remain bullish on Apple and the stock price closed Friday in the upper 25% of its 52 price range. Apple’s recent product releases of the iPhone 4 and the iPad have had phenomenal success.

Piqqem uses a -100 to 100 scale and leverages the wisdom of crowds and its own proprietary algorithms to capture and calculate sentiment. Any sentiment rating above 25 is considered positive, below 0 is considered negative, while 0-25 is considered neutral. Changes in sentiment are also crucial in understanding and interpreting a company’s sentiment ahead of an event like earnings. Finally, market forces need to be considered to make sure overall market sentiment changes are not overly influencing a stock’s individual sentiment.